NOC insurance, a critical yet often overlooked aspect of business risk management, is rapidly gaining prominence. This specialized coverage protects businesses against financial losses stemming from operational disruptions caused by events beyond their direct control. From manufacturing halts due to unforeseen equipment failures to supply chain bottlenecks, understanding the nuances of NOC insurance is paramount for mitigating significant financial and reputational damage.

This guide delves into the intricacies of NOC insurance, exploring its scope, coverage options, claim processes, and the crucial role it plays in regulatory compliance. We’ll examine the factors influencing premium costs, provide a framework for selecting the right provider, and offer insights into potential future trends in this evolving landscape.

The goal? To equip businesses with the knowledge to navigate the complexities of NOC insurance and secure the appropriate protection for their operations.

Definition and Scope of NOC Insurance

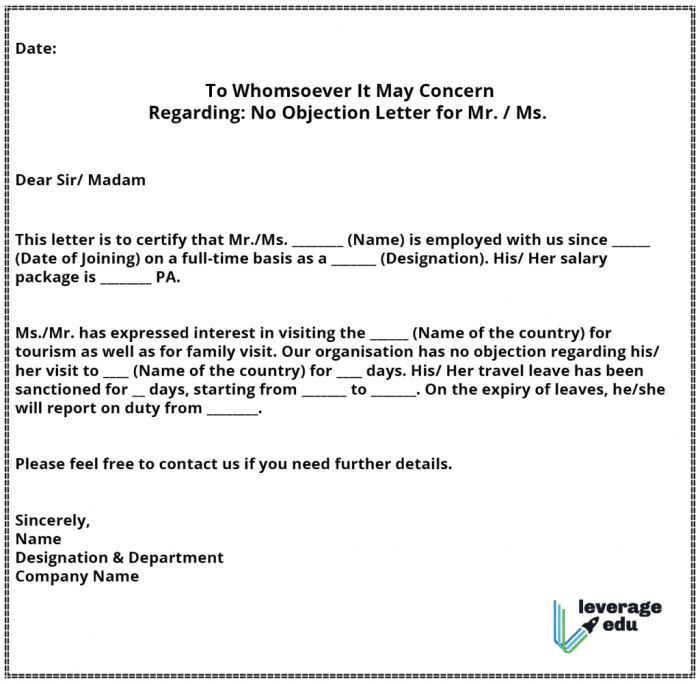

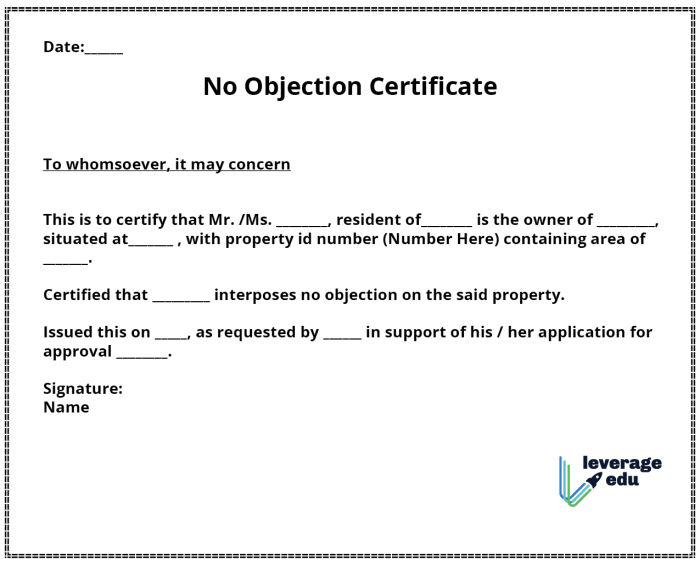

NOC insurance, or No-Objection Certificate insurance, is a specialized type of indemnity insurance designed to protect businesses against financial losses arising from delays or disruptions caused by the non-issuance or late issuance of necessary approvals or clearances (NOCs). These approvals are often required from various governmental or regulatory bodies before a project can commence or continue.

The core purpose is to mitigate the significant financial risks associated with bureaucratic hurdles and potential project standstills.NOC insurance operates by providing financial compensation to the insured party if a required NOC is not obtained within a specified timeframe, or if its issuance is unreasonably delayed.

This compensation typically covers direct financial losses incurred due to the delay, such as lost revenue, project overruns, and penalties. The policy’s scope is defined by the specific NOCs required for the project and the agreed-upon timeframe for their acquisition.

Types of Businesses Requiring NOC Insurance

Businesses operating in sectors with stringent regulatory frameworks frequently utilize NOC insurance. This includes industries characterized by complex approval processes and significant upfront investments, where even short delays can lead to substantial financial setbacks. The high cost of delays in these sectors makes NOC insurance a valuable risk management tool.

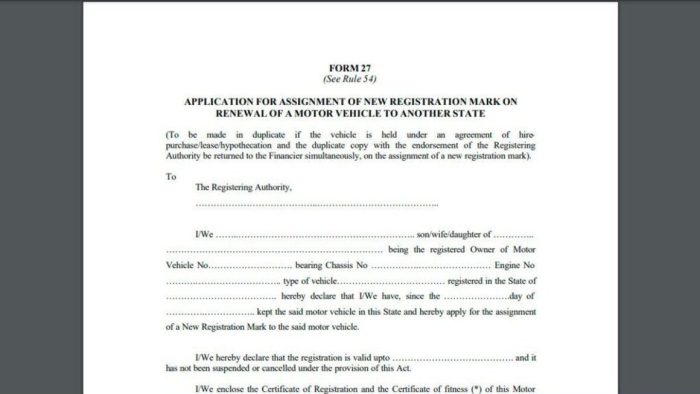

Examples include infrastructure projects (construction, energy, transportation), manufacturing facilities, particularly those involving hazardous materials, and large-scale real estate developments. Furthermore, companies engaging in cross-border transactions or those operating in politically unstable regions might also find this type of insurance particularly beneficial.

Situations Where NOC Insurance is Crucial

Several scenarios highlight the critical role of NOC insurance. For example, consider a construction company embarking on a large-scale infrastructure project. Delays in obtaining environmental clearances or building permits can lead to significant penalties, lost revenue from missed deadlines, and increased project costs.

NOC insurance would protect the company from these financial repercussions. Similarly, a manufacturing plant seeking to expand operations might face delays in obtaining operational licenses or approvals related to environmental compliance. The associated downtime and potential penalties could be mitigated through appropriate NOC insurance coverage.

Another compelling example is a company involved in a cross-border transaction requiring approvals from multiple regulatory bodies. The complexity and potential for unforeseen delays in securing these approvals make NOC insurance a prudent risk management strategy. In essence, any project with a significant dependence on external approvals benefits from the protection offered by NOC insurance.

Coverage Provided by NOC Insurance Policies

NOC insurance policies, designed to mitigate the financial risks associated with obtaining a No Objection Certificate (NOC), offer a range of coverage options tailored to the specific needs of the insured. The extent of this coverage varies significantly depending on the policy’s terms and the chosen level of protection.

Understanding the nuances of these policies is crucial for businesses and individuals seeking to safeguard their investments and avoid potential financial setbacks.Standard coverage typically includes compensation for direct financial losses incurred due to delays or denials in obtaining the required NOC.

This can encompass legal fees, administrative charges, and penalties imposed for non-compliance. Furthermore, many policies extend coverage to include expenses related to rectifying any issues that might hinder the NOC issuance process. The specific inclusions and exclusions will be clearly defined within the policy document.

Standard Coverage Inclusions

A typical NOC insurance policy provides a foundation of coverage elements designed to address common challenges in the NOC acquisition process. These generally include reimbursement for documented expenses directly related to obtaining the NOC, such as application fees, processing fees, and legal consultation fees.

Policies may also cover penalties imposed due to delays in obtaining the NOC, provided the delay is not attributable to the insured’s negligence or willful misconduct. Crucially, the policy will Artikel specific conditions and limits on the amount of compensation payable for each covered expense.

For instance, a policy might set a maximum limit on legal fees or penalties.

Optional Add-ons and Extensions

Beyond the standard coverage, insurers often offer optional add-ons or extensions to enhance the policy’s protection. These can include coverage for losses incurred due to third-party actions, such as delays caused by government agencies or other stakeholders. Another common add-on is coverage for reputational damage stemming from NOC-related delays or failures.

These extensions usually come at an additional premium and are subject to specific terms and conditions. For example, an add-on might cover losses related to missed business opportunities directly resulting from the delay in obtaining the NOC, provided such opportunities are demonstrably quantifiable and directly linked to the NOC delay.

Comparison of Different Coverage Levels

NOC insurance policies are typically offered in various levels, ranging from basic to comprehensive. Basic policies offer minimal coverage, primarily focusing on direct expenses related to the NOC application process. Comprehensive policies, on the other hand, provide broader protection, encompassing a wider range of potential losses, including those stemming from third-party actions, reputational damage, and lost business opportunities.

The premium for a comprehensive policy will naturally be higher than that of a basic policy. The choice of coverage level should be carefully considered based on the insured’s risk tolerance and the potential financial implications of NOC-related delays or denials.

A thorough assessment of the specific project and potential risks involved is essential in selecting the appropriate coverage level. For example, a large-scale construction project might warrant a comprehensive policy, while a smaller project might only require basic coverage.

Claim Process and Procedures

Filing a claim under a No Objection Certificate (NOC) insurance policy typically involves a straightforward process, though specifics may vary depending on the insurer and the nature of the claim. Understanding the steps involved and the necessary documentation ensures a smoother and more efficient claim resolution.

Proactive preparation minimizes potential delays.The claim process generally requires prompt notification to the insurer following the event necessitating the claim. This initial contact sets the claim in motion and allows the insurer to begin the assessment process. Failing to notify the insurer promptly can jeopardize the claim.

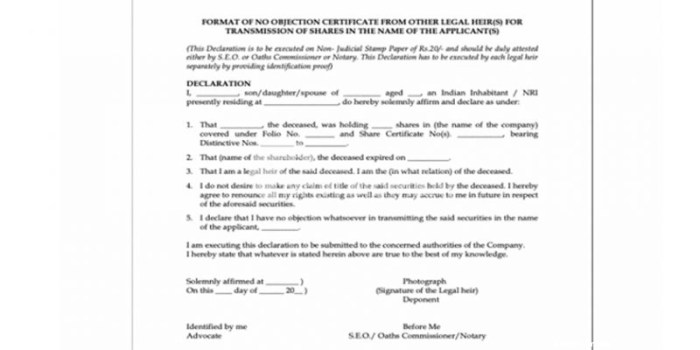

Required Documentation for a Successful NOC Claim

Supporting documentation is crucial for a successful NOC insurance claim. The insurer will need verifiable evidence to substantiate the claim and assess its validity. Insufficient or inaccurate documentation can lead to delays or even claim rejection. Commonly required documents include the original NOC, proof of loss or damage, police reports (if applicable), and any relevant communication with involved parties.

Specific requirements will be Artikeld in the policy document.

Step-by-Step NOC Insurance Claim Process

The claim process can be streamlined by following a structured approach. This process ensures all necessary steps are completed efficiently, maximizing the chances of a successful outcome.

| Step | Action | Timeline | Supporting Documentation |

|---|---|---|---|

| 1 | Notify the insurer immediately upon the occurrence of the event covered by the NOC insurance policy. This typically involves a phone call followed by a written notification. | Within 24-48 hours of the event. | Policy details, contact information, brief description of the event. |

| 2 | Complete and submit a claim form provided by the insurer. This form typically requests detailed information about the event and the associated losses. | Within 7 days of the initial notification. | Completed claim form, copies of identification documents. |

| 3 | Gather and submit all necessary supporting documentation. This may include the original NOC, police reports (if applicable), invoices, receipts, and other relevant evidence. | Within 14 days of the initial notification. | Original NOC, police report (if applicable), invoices, receipts, photographs of damage (if applicable). |

| 4 | Cooperate fully with the insurer’s investigation. This may involve providing additional information or attending interviews. | As required by the insurer. | Any documents requested by the insurer. |

| 5 | Review and accept the insurer’s claim assessment. If you disagree with the assessment, you have the right to appeal the decision according to the terms of your policy. | Typically within 30-60 days of submitting all documentation. | Correspondence with the insurer. |

Factors Affecting NOC Insurance Premiums

The cost of NOC (No Objection Certificate) insurance premiums is influenced by a complex interplay of factors, reflecting the inherent risks associated with the specific circumstances of each insured entity. Understanding these factors is crucial for businesses seeking to secure cost-effective and appropriate coverage.

This analysis will examine key elements impacting premium calculation, emphasizing the role of risk assessment and business specifics.Several key variables significantly influence the final premium charged for NOC insurance. These factors interact to create a unique risk profile for each applicant, directly impacting the cost of coverage.

Insurers employ sophisticated actuarial models to weigh these factors and arrive at a fair and accurate premium.

Business Size and Industry

The size and sector of a business substantially affect its NOC insurance premium. Larger companies, particularly those operating in high-risk industries, typically face higher premiums due to the increased potential for liabilities and associated claims. For instance, a multinational corporation in the manufacturing sector will likely pay a significantly higher premium than a small, local service provider.

This disparity reflects the greater financial exposure and potential for large-scale claims associated with larger, more complex operations. Industry-specific regulations and historical claims data also contribute to these differences. Industries with higher incidences of NOC-related disputes or legal challenges will generally command higher premiums.

Risk Assessment and Premium Determination

Risk assessment is the cornerstone of NOC insurance premium calculation. Insurers conduct thorough evaluations, examining various aspects of the applicant’s operations and history to gauge potential liabilities. This comprehensive assessment involves scrutinizing the applicant’s financial stability, operational procedures, compliance history, and the nature of the activities requiring NOC insurance.

A detailed review of past claims, legal disputes, and regulatory infractions is also a standard part of the process. High-risk profiles, characterized by a history of legal challenges or non-compliance, will naturally lead to higher premiums. Conversely, businesses with a strong track record of compliance and a robust risk management framework can expect more favorable rates.

The specifics of the NOC itself, such as the type of permission sought and the potential impact of its denial, also play a critical role in shaping the final premium. For example, a NOC required for a high-value construction project will typically attract a higher premium compared to one needed for a smaller-scale operation.

Sophisticated algorithms and statistical modeling techniques are utilized to quantify these risks and translate them into a numerical premium.

NOC Insurance and Regulatory Compliance

Navigating the complex landscape of NOC (No Objection Certificate) insurance necessitates a thorough understanding of the regulatory framework governing its issuance and utilization. Compliance with these regulations is paramount for both insurers and businesses seeking coverage, ensuring the validity and enforceability of the insurance policy and mitigating potential legal risks.The specific regulations governing NOC insurance vary depending on the jurisdiction and the nature of the underlying activity requiring the NOC.

However, common threads involve adherence to local insurance laws, compliance with industry best practices, and accurate representation of the insured risk. Insurers must obtain the necessary licenses and approvals, maintain adequate reserves, and adhere to reporting requirements mandated by regulatory bodies.

Businesses, in turn, must accurately disclose all relevant information when applying for NOC insurance to avoid potential policy invalidations.

Regulatory Bodies and Oversight

Regulatory oversight of NOC insurance typically falls under the purview of national or regional insurance commissions or similar authorities. These bodies establish the legal framework, define underwriting standards, and enforce compliance through regular audits and inspections. For instance, in many jurisdictions, insurers are required to submit annual reports detailing their financial health, underwriting practices, and claims experience.

Non-compliance can lead to penalties, including fines, license suspension, or even revocation. Furthermore, the specific regulatory requirements often depend on the type of NOC being insured, as certain industries are subject to stricter regulations than others. For example, NOCs related to hazardous materials handling or environmental projects may face heightened scrutiny.

Meeting Legal Obligations Through NOC Insurance

NOC insurance plays a crucial role in helping businesses meet their legal obligations. Many legal and regulatory requirements mandate the possession of adequate insurance coverage before a specific activity can commence. This is particularly true in high-risk sectors such as construction, transportation, and manufacturing.

By securing appropriate NOC insurance, businesses demonstrate their commitment to risk mitigation and their ability to compensate for potential damages or losses arising from their operations. This compliance minimizes the risk of legal action and helps maintain a positive reputation.

Consequences of Inadequate NOC Insurance

Failure to secure adequate NOC insurance can expose businesses to significant legal and financial consequences. In the event of an incident or accident, a lack of sufficient coverage could lead to substantial liabilities that the business may be unable to meet.

This could result in lawsuits, judgments against the business, and potentially even bankruptcy. Furthermore, regulatory bodies may impose penalties for operating without the required insurance coverage, adding to the financial burden. In certain cases, inadequate insurance could even lead to criminal charges if the lack of coverage is deemed to be negligent or reckless.

For example, a construction company operating without the necessary liability insurance and causing damage to a neighboring property could face significant legal repercussions, including substantial fines and compensation payments.

Choosing the Right NOC Insurance Provider

Selecting the appropriate NOC insurance provider is crucial for mitigating operational risks and ensuring business continuity. The market offers a diverse range of insurers, each with unique strengths and weaknesses. A thorough evaluation process, encompassing a comprehensive comparison of offerings and a robust decision-making framework, is essential for securing optimal coverage at a competitive price.

Provider Offering Comparison

Different NOC insurance providers offer varying levels of coverage, policy terms, and service quality. Some insurers specialize in specific industries or types of NOC operations, offering tailored solutions. Others provide broader coverage but may lack the nuanced understanding of specific operational challenges.

Key differentiators include the breadth of coverage offered (e.g., cyber liability, data breach, regulatory fines), the claims handling process efficiency, and the insurer’s financial stability and reputation. A direct comparison of policy documents is essential to identify these variations.

For example, Insurer A might offer higher coverage limits for cyber liability but a more complex claims process, while Insurer B might offer more streamlined claims handling but lower coverage limits.

Decision-Making Framework for Provider Selection

A structured approach is vital for selecting a suitable NOC insurance provider. This framework should encompass the following steps: First, define your organization’s specific risk profile, identifying potential vulnerabilities and assessing the potential financial impact of various incidents.

Second, establish clear criteria for evaluating potential insurers, including financial strength ratings (e.g., A.M. Best ratings), claims handling experience, policy terms, and premium costs. Third, solicit proposals from multiple insurers, ensuring a consistent comparison basis. Fourth, carefully review each proposal, paying close attention to exclusions, limitations, and conditions.

Finally, select the provider that best aligns with your risk profile and budgetary constraints, prioritizing a balance between comprehensive coverage and affordability.

Best Practices for Negotiating Policy Terms

Negotiating favorable policy terms is crucial to securing optimal protection. This involves a thorough understanding of your organization’s specific needs and a clear articulation of your risk profile to the insurer. Effective negotiation strategies include: presenting a comprehensive risk assessment demonstrating proactive risk mitigation efforts; exploring various coverage options to identify the most cost-effective solution; comparing offers from multiple insurers to leverage competitive pricing; and engaging legal counsel to review the policy terms before finalizing the agreement.

For instance, negotiating broader coverage for specific vulnerabilities or securing favorable terms regarding the claims process can significantly impact the overall value of the insurance policy. Remember to document all agreed-upon terms and conditions in writing.

Benefits of Obtaining NOC Insurance

NOC insurance, while often overlooked, offers significant advantages for businesses operating in complex regulatory environments. Its primary benefit lies in mitigating substantial financial risks associated with non-compliance, safeguarding both operational continuity and long-term profitability. This protection extends beyond mere financial security, impacting a company’s reputation and stakeholder confidence.Protecting Against Financial LossesNOC insurance provides a crucial financial safety net by covering potential liabilities arising from regulatory breaches.

The costs associated with regulatory investigations, penalties, legal fees, and remediation efforts can be crippling for even established businesses. For instance, a company facing a data breach due to non-compliance with data privacy regulations could incur millions in fines and legal costs.

NOC insurance would cover a significant portion of these expenses, preventing severe financial distress. The policy’s coverage typically includes costs associated with defending against regulatory actions, as well as the payment of fines and penalties levied. The precise coverage varies depending on the specific policy and the regulatory landscape.

Impact on Business Reputation

A regulatory breach can severely damage a company’s reputation, impacting its ability to attract and retain clients, investors, and employees. Negative publicity surrounding non-compliance can lead to a loss of consumer trust and decreased market share. NOC insurance helps mitigate reputational damage by providing resources for crisis management and public relations.

This can involve hiring experts to manage the fallout from a regulatory incident, helping to contain the damage and restore public confidence. By actively addressing the situation and demonstrating a commitment to regulatory compliance, businesses can lessen the long-term negative impact on their reputation.

A proactive approach, supported by NOC insurance, can often turn a potentially devastating situation into a demonstration of responsible corporate citizenship.

Potential Risks and Exclusions in NOC Insurance Policies

NOC insurance, while offering crucial protection for businesses, isn’t a blanket guarantee against all potential liabilities. Understanding the limitations and exclusions within a policy is vital for effective risk management. This section details common exclusions and scenarios where coverage may be limited or absent.

Standard NOC insurance policies often contain exclusions that limit coverage for specific types of risks or circumstances. These exclusions are carefully worded and can be complex, requiring thorough review by legal counsel. Failure to understand these limitations can lead to significant financial losses in the event of a claim.

Common Exclusions in NOC Insurance Policies

A variety of factors can lead to a claim being denied. These exclusions are designed to manage risk and prevent the insurer from covering liabilities outside the intended scope of the policy. Understanding these common exclusions is crucial for businesses seeking to secure appropriate coverage.

- Intentional Acts:NOC insurance typically excludes coverage for losses resulting from intentional acts of the insured party or their employees. This prevents misuse of the policy for fraudulent claims.

- Existing Conditions:Pre-existing conditions or known issues at the time the policy is issued are often excluded. This means that problems identified before policy inception won’t be covered by the insurance.

- Governmental Actions:Losses stemming from governmental actions, such as seizures or regulatory shutdowns, are typically excluded from coverage.

- War and Terrorism:NOC insurance policies usually exclude coverage for losses directly caused by acts of war, terrorism, or civil unrest.

- Nuclear Events:Damage or losses resulting from nuclear incidents are often specifically excluded from coverage.

Risks Not Covered by Standard NOC Insurance Policies

Beyond the specific exclusions listed above, several risks may not be covered by standard NOC insurance policies, highlighting the need for comprehensive risk assessment and potentially supplemental insurance.

- Reputational Damage:While NOC insurance might cover financial losses from operational disruptions, it rarely covers damage to a company’s reputation, which can be equally devastating.

- Cybersecurity Breaches:Standard NOC policies may not adequately cover losses from data breaches or cyberattacks, requiring separate cybersecurity insurance.

- Environmental Damage:Environmental liabilities, such as pollution or contamination, may not be fully covered under standard NOC policies, requiring specific environmental liability insurance.

- Employee Misconduct:While some policies might offer limited coverage for employee dishonesty, comprehensive coverage for employee misconduct often requires separate fidelity bonds or crime insurance.

Examples of Uncovered Scenarios

Several real-world scenarios illustrate the limitations of NOC insurance. These examples underscore the importance of carefully reviewing policy wording and considering supplemental insurance to mitigate potential risks.

- A factory fire caused by an employee intentionally setting fire to the building would likely be excluded due to the intentional act.

- A company suffers significant financial losses due to a negative news story damaging its reputation; this reputational damage is usually not covered under standard NOC insurance.

- A data breach exposes sensitive customer information, leading to significant fines and legal costs. Standard NOC insurance may not fully cover these cybersecurity-related expenses.

Case Studies of NOC Insurance Claims

Analyzing real-world scenarios illuminates the practical application and complexities of NOC insurance. The following case studies illustrate both successful and unsuccessful claims, highlighting the importance of policy understanding and proper documentation.

Successful NOC Insurance Claim: Timely Project Completion

This case involves a construction firm, “Apex Builders,” undertaking a large-scale residential development project. Apex Builders secured an NOC insurance policy to mitigate potential delays due to unforeseen circumstances. During the project, a significant water main break disrupted access to the site for three weeks.

Apex Builders immediately notified their insurer and provided comprehensive documentation, including project schedules, engineering reports detailing the disruption, and invoices for incurred expenses.

- Circumstances:Unforeseen water main break causing a three-week delay in construction.

- Actions Taken:Prompt notification of the insurer, submission of detailed documentation supporting the claim, and diligent record-keeping of all expenses related to the delay.

- Outcome:The insurer approved the claim, covering the majority of the additional costs incurred due to the delay, ensuring Apex Builders met their project deadlines and avoided substantial financial losses.

Unsuccessful NOC Insurance Claim: Inadequate Documentation

“GreenTech Solutions,” a software development company, purchased NOC insurance to cover potential delays in a major software launch. However, the launch was delayed due to unforeseen compatibility issues with a third-party software component. GreenTech Solutions filed a claim, but their documentation was insufficient to support their claim.

- Circumstances:Software launch delayed due to unforeseen compatibility issues with a third-party software component.

- Actions Taken:The claim was filed, but supporting documentation was lacking, failing to clearly establish the direct link between the delay and the insured risk.

- Outcome:The insurer denied the claim due to insufficient evidence linking the delay to a covered peril under the policy. The lack of comprehensive documentation and a clear chain of events ultimately prevented GreenTech Solutions from receiving compensation.

Successful NOC Insurance Claim: Third-Party Liability

“Global Logistics,” an international shipping company, secured NOC insurance to cover potential liabilities arising from delays in shipments. A significant port strike in a key transit hub caused a month-long delay for several high-value shipments. Global Logistics successfully invoked their policy to cover compensation paid to clients affected by the delays.

- Circumstances:Port strike causing a month-long delay in several high-value shipments, resulting in client compensation obligations.

- Actions Taken:Global Logistics promptly notified their insurer, providing detailed documentation of the port strike, proof of client compensation payments, and copies of contracts outlining liability clauses.

- Outcome:The insurer reviewed the documentation and, finding it complete and compliant with the policy terms, approved the claim, covering the compensation paid to clients, thus mitigating Global Logistics’ financial exposure.

Future Trends in NOC Insurance

The NOC insurance market, while still relatively nascent, is poised for significant transformation driven by technological advancements and evolving regulatory landscapes. The increasing interconnectedness of global operations and the growing complexity of regulatory compliance will necessitate further innovation and adaptation within the industry.The rapid pace of technological change will profoundly reshape the NOC insurance landscape.

Data analytics, AI, and machine learning are already starting to impact underwriting, risk assessment, and claims processing, leading to more efficient and accurate evaluations. This trend will only accelerate in the coming years.

Impact of Technological Advancements

The integration of advanced technologies is expected to streamline various aspects of NOC insurance. For example, the use of blockchain technology could enhance transparency and security in the claims process, reducing fraud and disputes. Predictive modeling, powered by AI, can improve risk assessment by analyzing vast datasets to identify potential liabilities more effectively than traditional methods.

This leads to more accurate pricing and a reduction in unnecessary premiums. Furthermore, the increasing adoption of IoT devices can provide real-time data on operational processes, allowing insurers to offer more tailored and responsive coverage. For instance, a manufacturer could have sensors monitoring their production lines, feeding data into an NOC insurance policy that adjusts premiums based on real-time risk levels.

Expansion of Coverage and Product Offerings

The future will likely see an expansion of NOC insurance coverage to encompass a wider range of risks and operational complexities. As businesses become more reliant on technology and interconnected systems, the potential for disruptions and associated liabilities will increase, demanding more comprehensive insurance solutions.

This includes expanding coverage beyond traditional areas like environmental liabilities to encompass cyber risks, data breaches, and reputational damage directly impacting operational continuity. We can expect the emergence of specialized NOC insurance products tailored to specific industry sectors and operational models.

For example, a bespoke policy for a pharmaceutical company would differ significantly from one designed for a technology firm, reflecting their unique operational risks and compliance requirements.

Increased Focus on Proactive Risk Management

The future of NOC insurance will be less about reactive claims handling and more about proactive risk management. Insurers are likely to increasingly emphasize risk mitigation strategies, offering clients support and guidance in implementing robust operational procedures to minimize the likelihood of disruptions.

This might involve providing access to expert consultants, offering training programs on best practices, or developing risk assessment tools for clients. This shift reflects a move towards a more holistic approach to risk management, where insurance is not just a safety net but a partner in ensuring operational resilience.

This could involve partnerships between insurers and technology providers to offer integrated risk management solutions, combining insurance coverage with technological tools for monitoring and mitigating risks. For example, an insurer might partner with a cybersecurity firm to provide clients with both insurance and proactive cybersecurity services.

Illustrative Examples of NOC Insurance Scenarios

NOC insurance, while often overlooked, plays a crucial role in mitigating financial risks associated with various operational disruptions. Understanding the diverse scenarios where such insurance is vital is key to effective risk management. The following examples illustrate the breadth of situations where NOC insurance provides a critical safety net.

Scenario 1: Data Breach Leading to Business Interruption

A multinational technology company experiences a significant data breach, resulting in the loss of sensitive customer information and a subsequent regulatory investigation. The company is forced to temporarily suspend operations while it addresses the breach and complies with regulatory requirements. This downtime leads to substantial revenue loss and significant legal and remediation costs. NOC insurance, with appropriate coverage, would compensate the company for these losses, including costs associated with cybersecurity experts, legal counsel, public relations, and business interruption. The expected outcome is a swift recovery, minimizing the long-term financial impact of the breach.

Scenario 2: Natural Disaster Affecting Manufacturing Operations

A severe hurricane causes widespread flooding, damaging a manufacturing plant’s infrastructure and halting production. The plant’s operations are disrupted for several months due to repairs and supply chain disruptions. The potential risks include significant loss of revenue, damage to equipment, and potential liabilities to customers due to delayed orders. NOC insurance, covering business interruption and property damage, would provide financial protection against these losses, allowing the company to rebuild and resume operations more quickly. The expected outcome is financial recovery and a quicker return to operational capacity.

Scenario 3: Cyberattack Targeting Critical Infrastructure

A critical infrastructure provider, such as an energy company, suffers a sophisticated cyberattack that disrupts its operations. This results in widespread power outages, impacting numerous businesses and consumers. The potential risks include substantial financial losses due to lost revenue, regulatory penalties, and potential litigation from affected parties. NOC insurance with specific coverage for cyberattacks on critical infrastructure would help mitigate these risks. The expected outcome is faster recovery and reduced financial strain from the attack’s consequences.

Scenario 4: Supplier Default Leading to Production Halt

A key supplier of raw materials for a pharmaceutical company declares bankruptcy, disrupting the company’s production process. The company faces significant delays in fulfilling orders, resulting in potential penalties and reputational damage. The potential risks include lost revenue, contractual penalties, and damage to the company’s reputation. NOC insurance, with coverage for supply chain disruptions, would help compensate for the lost revenue and associated costs. The expected outcome is mitigation of financial losses and maintenance of the company’s reputation.

Scenario 5: Government Regulatory Action Causing Operational Shutdown

A food processing plant is temporarily shut down due to a government regulatory action following a food safety incident. The plant faces substantial losses due to production downtime and potential legal costs. The potential risks encompass lost revenue, regulatory fines, and potential legal liabilities. NOC insurance covering regulatory actions and product recalls would help the company manage these risks. The expected outcome is reduced financial impact and a more streamlined recovery process.

Final Wrap-Up

In conclusion, securing adequate NOC insurance is no longer a luxury but a necessity for businesses operating in today’s volatile environment. By understanding the coverage options, claim procedures, and regulatory implications, businesses can proactively mitigate risks, safeguard their financial stability, and maintain a strong reputation.

Proactive risk assessment, careful provider selection, and a thorough understanding of policy terms are crucial steps in building a robust risk management strategy that incorporates comprehensive NOC insurance.