Blue Cross Blue Shield (BCBS), a household name in the American healthcare landscape, has long been a trusted provider of health insurance plans. With a vast network of providers, diverse coverage options, and a commitment to community health, BCBS offers a comprehensive approach to safeguarding individuals and families from the financial burden of medical expenses.

This in-depth guide explores the intricacies of BCBS health insurance, covering its history, products, services, enrollment process, claims handling, and more. We delve into the unique advantages of BCBS plans for individuals, families, and employers, while also providing a comparative analysis against other major health insurance providers.

BCBS Overview

Blue Cross Blue Shield (BCBS) is a leading provider of health insurance in the United States, offering a wide range of plans to individuals, families, and employers. Its history dates back to the 1930s, when the Great Depression led to the creation of the first Blue Cross plan in Baylor University Hospital, Texas. The idea was to provide affordable hospital care to teachers.

The success of this early plan led to the development of Blue Shield plans, which focused on covering physician services. The Blue Cross and Blue Shield organizations eventually merged, forming a network of independent, locally-owned and operated companies across the country.

Core Values and Mission

BCBS’s core values and mission are centered around providing affordable and accessible healthcare to its members. The organization aims to improve the health of its members by promoting wellness, prevention, and early detection of health issues.

The mission of BCBS is to “deliver high-quality, affordable health insurance to all Americans.” The organization is committed to:

- Ensuring access to quality healthcare for all

- Providing affordable health insurance options

- Improving the health of its members

- Promoting wellness and prevention

Structure of BCBS

The structure of BCBS is a unique combination of national and regional entities. The national entity, the Blue Cross Blue Shield Association (BCBSA), serves as a coordinating body for the independent Blue Cross and Blue Shield plans across the country.

BCBSA provides support to the individual plans in areas such as:

- National advocacy

- Research and development

- Marketing and communications

- Technology and data

The individual Blue Cross and Blue Shield plans operate independently in their respective regions, offering health insurance products and services to their local communities. These plans are regulated by state insurance departments and are responsible for setting their own rates and benefits.

The structure of BCBS allows for flexibility and responsiveness to local market needs, while also providing a national platform for advocacy and innovation.

BCBS Products and Services

Blue Cross Blue Shield (BCBS) offers a comprehensive range of health insurance plans designed to meet the diverse needs of individuals, families, and businesses. These plans provide financial protection against the high costs associated with healthcare, ensuring access to quality medical services.

Health Insurance Plans

BCBS provides a variety of health insurance plans, each with unique coverage options and benefits. The most common types of plans include:

- Individual Health Insurance: These plans are designed for individuals and their families who are not covered by employer-sponsored plans. They offer various coverage options, including medical, dental, vision, and prescription drug coverage.

- Employer-Sponsored Health Insurance: These plans are offered by employers to their employees and their dependents. They typically offer a wider range of coverage options and benefits than individual plans.

- Medicare Supplement Insurance: These plans are designed to supplement Medicare coverage, helping to cover out-of-pocket expenses not covered by Original Medicare.

- Medicare Advantage Plans: These plans are offered by private insurance companies and are an alternative to Original Medicare. They offer a variety of benefits, including prescription drug coverage, vision, and dental care.

Coverage Options

Within each BCBS health insurance plan, there are various coverage options to choose from. These options can be customized to meet individual needs and budgets. Common coverage options include:

- Medical Coverage: This covers a wide range of medical services, including doctor visits, hospital stays, surgery, and prescription drugs.

- Dental Coverage: This covers preventive dental care, such as cleanings and checkups, as well as restorative treatments, such as fillings and crowns.

- Vision Coverage: This covers eye exams, eyeglasses, and contact lenses.

- Prescription Drug Coverage: This covers prescription drugs, including both generic and brand-name medications.

Supplemental Benefits

BCBS offers a range of supplemental benefits that can provide additional financial protection and peace of mind. These benefits can help cover expenses not covered by traditional health insurance plans. Some common supplemental benefits include:

- Critical Illness Insurance: This insurance provides a lump-sum payment to policyholders diagnosed with a critical illness, such as cancer or heart attack. This payment can help cover expenses related to treatment, lost income, and other financial burdens.

- Accident Insurance: This insurance provides coverage for accidents that result in injuries or death. It can help cover medical expenses, lost income, and other expenses related to the accident.

- Hospital Indemnity Insurance: This insurance provides a daily cash benefit to policyholders during a hospital stay. This benefit can help cover expenses not covered by traditional health insurance, such as lost wages or other out-of-pocket costs.

BCBS Network and Providers

Blue Cross Blue Shield (BCBS) boasts a vast nationwide network of healthcare providers, offering access to a wide range of medical services across the United States. This network is a cornerstone of BCBS’s value proposition, enabling members to receive care from a diverse group of qualified professionals.

Provider Network Structure

The BCBS network comprises a diverse group of healthcare providers, including physicians, hospitals, clinics, and other healthcare facilities. These providers are contracted with BCBS to offer their services to BCBS members at negotiated rates. The network’s structure ensures that members have access to quality care within their communities and across the country.

Factors Determining Provider Inclusion

Several factors influence a provider’s inclusion in the BCBS network.

- Provider Credentials and Experience: BCBS prioritizes providers with strong credentials, licenses, and board certifications, ensuring members receive care from qualified professionals.

- Quality of Care: BCBS evaluates providers based on their track record of delivering high-quality care, considering factors such as patient satisfaction, clinical outcomes, and adherence to best practices.

- Cost-Effectiveness: BCBS seeks to negotiate competitive rates with providers to ensure cost-effective care for members. This includes considering the provider’s fees, service offerings, and overall value proposition.

- Network Coverage: BCBS considers the provider’s location and specialization to ensure adequate network coverage across various geographic areas and medical specialties.

Finding In-Network Providers

BCBS provides members with multiple resources to locate in-network providers.

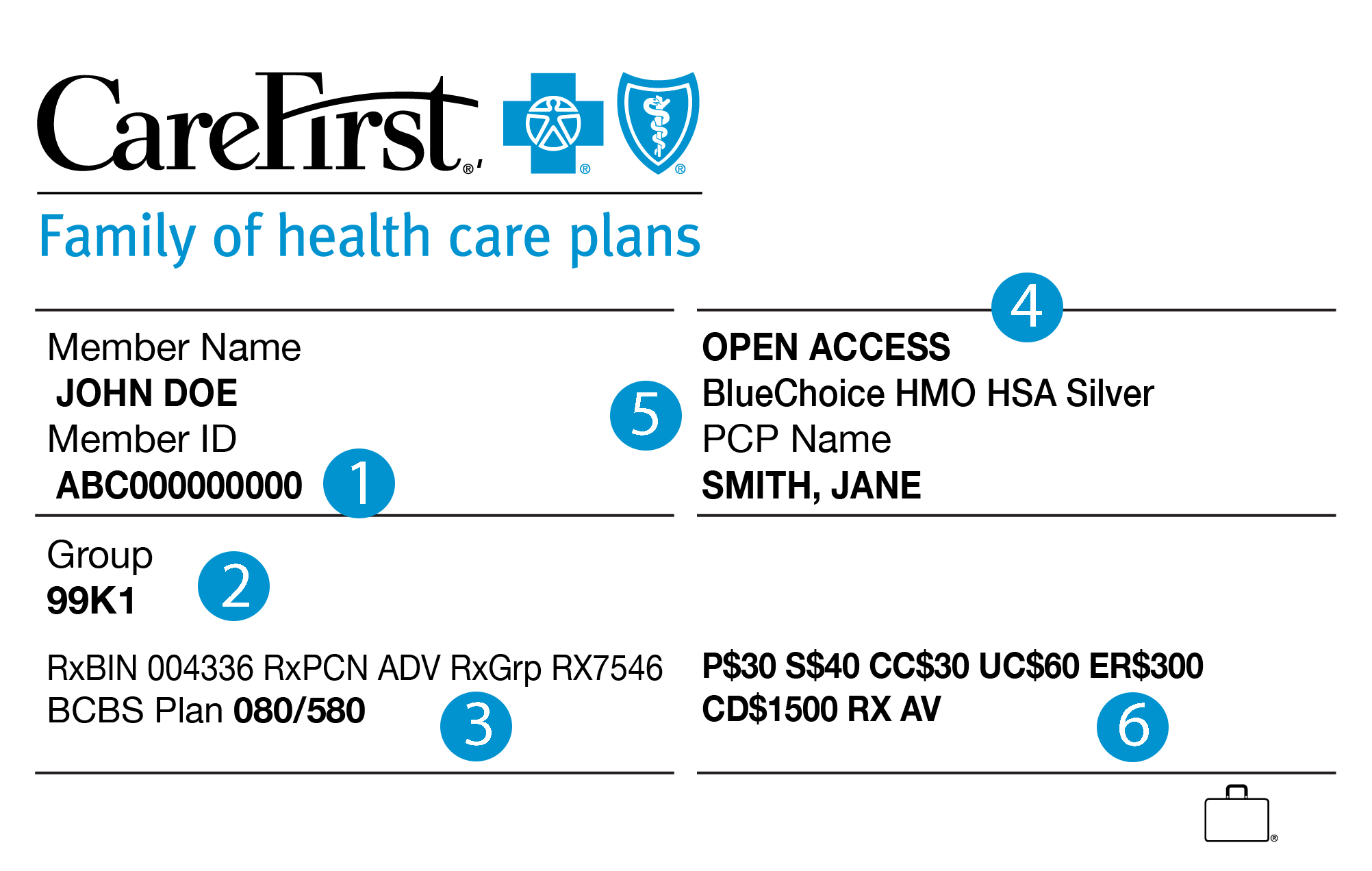

- BCBS Website: The BCBS website offers an online directory where members can search for providers by specialty, location, and other criteria.

- BCBS Mobile App: The BCBS mobile app provides a convenient way to find in-network providers on the go, offering similar search functionality as the website.

- BCBS Customer Service: Members can contact BCBS customer service for assistance in finding in-network providers, receiving guidance on navigating the network, and resolving any related inquiries.

Accessing Healthcare Services

Once a member identifies an in-network provider, they can schedule appointments and receive healthcare services.

- Appointment Scheduling: Members can contact the provider directly to schedule appointments, utilizing the provider’s preferred communication channels, such as phone, email, or online booking systems.

- Pre-Authorization: For certain procedures or services, BCBS may require pre-authorization from the member’s primary care physician or specialist. This process helps ensure that the service is medically necessary and covered by the member’s plan.

- Claims Processing: After receiving healthcare services, members should submit claims to BCBS for reimbursement. BCBS processes claims based on the member’s plan benefits and negotiated rates with the provider.

BCBS Enrollment and Premiums

Enrolling in a Blue Cross Blue Shield (BCBS) health insurance plan is a crucial step toward securing comprehensive medical coverage. This process involves several steps, and understanding the factors that influence premium costs is essential for making informed decisions.

Factors Influencing Premium Costs

Premium costs for BCBS health insurance plans are determined by various factors, including:

- Age: Generally, older individuals tend to have higher premium costs due to their increased likelihood of needing medical care.

- Location: Premiums can vary based on geographical location. Areas with higher healthcare costs may have higher premiums.

- Coverage Level: The level of coverage you choose, such as bronze, silver, gold, or platinum, directly affects your premium. Higher coverage levels usually come with higher premiums.

- Tobacco Use: Smokers typically pay higher premiums compared to non-smokers.

- Family Size: Premiums are often calculated based on the number of individuals covered under the plan.

Payment Options

BCBS offers various payment options for premiums, providing flexibility for individuals and families:

- Direct Billing: You can pay your premiums directly to BCBS through various methods, including online payments, mail-in checks, or automatic bank deductions.

- Payroll Deduction: If you are employed, you may be able to have your premiums deducted directly from your paycheck.

- Credit Card Payments: Some BCBS plans allow you to pay premiums using a credit card.

BCBS Claims and Customer Service

Navigating the claims process and accessing customer service are essential aspects of any health insurance plan. Blue Cross Blue Shield (BCBS) offers a comprehensive claims system and a range of customer service channels to support its members.

Filing a Claim with BCBS

BCBS members can file claims through various methods, including online, mail, or fax.

- Online Claims Filing: The BCBS website provides a secure portal for members to submit claims electronically. This method is convenient and allows for real-time tracking of claim status.

- Mail: Claims can be mailed to the address provided on the member’s insurance card or policy documents.

- Fax: Members can also fax claims to the designated fax number.

Contacting BCBS Customer Service

BCBS offers a variety of ways to reach its customer service representatives.

- Phone: Members can call a dedicated customer service line available 24/7 for assistance with claims, benefits, and other inquiries.

- Email: BCBS provides an email address for members to submit inquiries and receive responses.

- Live Chat: The BCBS website often features a live chat option for immediate assistance.

- Social Media: BCBS may have active social media accounts, such as Facebook or Twitter, where members can reach out with questions or concerns.

Resources and Support for BCBS Members

BCBS offers various resources and support to its members.

- Member Portal: The BCBS website provides a secure member portal with access to policy information, claims history, and other relevant details.

- Mobile App: BCBS often offers a mobile app for members to manage their health insurance, access benefits, and file claims on the go.

- Provider Directory: BCBS provides a directory of in-network providers to help members find healthcare professionals within their coverage network.

- Health Education Materials: BCBS offers educational materials on various health topics, providing members with information to manage their health and well-being.

BCBS for Individuals and Families

Blue Cross Blue Shield (BCBS) offers a comprehensive range of health insurance plans designed to meet the diverse needs of individuals and families. These plans provide financial protection against the high costs of healthcare, ensuring access to quality medical care and peace of mind.

Coverage Options for Different Life Stages

BCBS recognizes that healthcare needs evolve throughout life. To address this, they offer various coverage options tailored to specific life stages, including young adults and families with children.

- Young Adults: Young adults transitioning from their parents’ health insurance plans often find BCBS plans appealing due to their affordability and comprehensive coverage. BCBS offers individual plans with flexible options, including catastrophic coverage for lower premiums and comprehensive plans with broader benefits.

- Families with Children: BCBS plans for families prioritize comprehensive coverage for children, including preventive care, immunizations, and coverage for common childhood illnesses. They also offer maternity coverage for expectant mothers and newborn care, providing essential support during this crucial time.

Resources for Informed Decision-Making

BCBS provides individuals and families with a wealth of resources to help them make informed decisions about their health insurance plans.

- Online Plan Comparison Tools: BCBS websites feature user-friendly tools that allow individuals to compare different plans based on their needs and budget. These tools provide detailed information about coverage benefits, premiums, and out-of-pocket costs, enabling informed decision-making.

- Customer Service Representatives: BCBS offers dedicated customer service representatives who can answer questions, explain plan details, and provide personalized guidance. These representatives are available via phone, email, and online chat, ensuring easy access to support.

- Brochures and Educational Materials: BCBS provides comprehensive brochures and educational materials that explain the intricacies of health insurance and provide insights into plan options. These materials are available online and in print, allowing individuals to learn at their own pace.

BCBS for Employers

Blue Cross Blue Shield (BCBS) offers a wide range of health insurance plans designed to meet the specific needs of employers and their employees. BCBS understands the importance of providing comprehensive and affordable health coverage, which is why they offer various plans that cater to businesses of all sizes and industries.

Advantages of BCBS Plans for Employers

BCBS plans offer numerous advantages for employers, including:

- Cost Savings: BCBS plans can help employers save money on their healthcare costs through competitive premiums and negotiated rates with healthcare providers. BCBS’s extensive network and purchasing power allow them to negotiate lower rates with healthcare providers, resulting in cost savings for employers.

- Improved Employee Health and Productivity: By providing comprehensive health insurance, employers can promote the health and well-being of their employees. This can lead to increased productivity, reduced absenteeism, and lower healthcare costs in the long run. Employees with access to quality healthcare are more likely to be healthy and engaged in their work, contributing to a more productive workforce.

- Enhanced Employee Satisfaction and Retention: Offering competitive health insurance benefits is an essential factor in attracting and retaining top talent. Employees value comprehensive health coverage and consider it a valuable benefit. By providing attractive health insurance plans, employers can improve employee satisfaction and reduce turnover rates.

- Simplified Administration: BCBS offers streamlined administrative processes for employers, making it easier to manage employee health benefits. Their online platforms and dedicated customer support teams simplify enrollment, claims processing, and other administrative tasks.

- Access to a Wide Network of Providers: BCBS has a vast network of healthcare providers across the country, giving employees access to a wide range of specialists and services. This ensures that employees have convenient access to quality care, regardless of their location.

Types of Employer-Sponsored Health Insurance Plans Offered by BCBS

BCBS offers a variety of employer-sponsored health insurance plans, each with different coverage levels and features. Some common types of plans include:

- Health Maintenance Organization (HMO): HMO plans typically have lower premiums but require employees to choose a primary care physician (PCP) within the network. Referrals are usually required for specialist visits, and out-of-network care is generally not covered.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility than HMOs, allowing employees to see providers outside the network, but at a higher cost. They typically have higher premiums than HMOs but provide greater choice and flexibility.

- Exclusive Provider Organization (EPO): EPO plans are similar to HMOs but offer a wider network of providers. They usually have lower premiums than PPOs but may restrict out-of-network coverage.

- Point of Service (POS): POS plans combine features of HMOs and PPOs, allowing employees to choose between in-network and out-of-network providers. They generally have higher premiums than HMOs but offer more flexibility.

- High Deductible Health Plan (HDHP): HDHPs have lower premiums but higher deductibles than traditional plans. They are often paired with a Health Savings Account (HSA), which allows employees to save pre-tax dollars for healthcare expenses.

Tools and Resources Available to Employers to Manage Employee Health Benefits

BCBS provides employers with a range of tools and resources to help them manage their employee health benefits effectively. These resources include:

- Online Portals: BCBS offers secure online portals for employers to access information about their plans, enroll employees, track claims, and manage other administrative tasks.

- Dedicated Customer Support: BCBS provides dedicated customer support teams to assist employers with any questions or concerns they may have regarding their health insurance plans.

- Wellness Programs: BCBS offers wellness programs that can help employers promote employee health and well-being. These programs may include health screenings, fitness challenges, and educational resources.

- Employee Education and Communication Tools: BCBS provides employers with tools and resources to educate employees about their health insurance benefits and encourage them to make informed decisions about their healthcare. These tools may include brochures, online resources, and webinars.

BCBS Technology and Innovation

Blue Cross Blue Shield (BCBS) is at the forefront of healthcare innovation, leveraging technology to enhance access, improve efficiency, and personalize member experiences. The organization’s commitment to technological advancement is evident in its robust digital platforms, data-driven insights, and strategic partnerships.

Digital Tools and Platforms

BCBS offers a range of digital tools and platforms designed to empower members and streamline healthcare interactions. These platforms provide convenient access to health information, manage benefits, and navigate the healthcare system.

- Member Portals: Secure online portals allow members to access their health plan information, view claims, manage benefits, and communicate with BCBS representatives. These portals offer a centralized hub for managing health-related needs.

- Mobile Apps: BCBS mobile applications provide on-the-go access to essential health information, including provider directories, prescription refill requests, and health plan details. These apps enhance convenience and promote self-management of health.

- Telehealth Services: BCBS integrates telehealth platforms, enabling members to consult with healthcare providers virtually. This service expands access to care, particularly in remote areas or for individuals with limited mobility.

Data-Driven Insights and Analytics

BCBS leverages data analytics to identify trends, improve health outcomes, and optimize care delivery. By analyzing vast amounts of health data, BCBS can:

- Identify high-risk populations: Data analysis helps identify individuals at risk for specific health conditions, enabling targeted interventions and preventive care strategies.

- Optimize care pathways: BCBS uses data to streamline care processes, reducing unnecessary procedures and improving efficiency. This can lead to better outcomes and lower healthcare costs.

- Personalize member experiences: By analyzing member preferences and health data, BCBS can tailor health plan options and communication strategies to individual needs.

Innovation and Future of Healthcare

BCBS actively participates in the evolution of healthcare, embracing emerging technologies and collaborating with innovators to shape the future of healthcare.

- Artificial Intelligence (AI): BCBS is exploring AI applications in areas like fraud detection, claims processing, and personalized health recommendations. AI algorithms can analyze vast datasets to identify patterns and optimize healthcare delivery.

- Blockchain Technology: BCBS is investigating the use of blockchain for secure data storage and sharing, enhancing data privacy and interoperability. This technology can facilitate seamless data exchange between healthcare providers and insurers.

- Wearable Technology: BCBS is integrating wearable devices into health plans, allowing members to track their health metrics and receive personalized health insights. This data can inform preventive care strategies and promote healthy lifestyle choices.

BCBS Community Engagement

Blue Cross Blue Shield (BCBS) is committed to improving the health and well-being of communities across the nation. Beyond providing quality health insurance, BCBS actively engages in initiatives that address community health needs and promote healthier lifestyles.

Community Health Initiatives

BCBS’s commitment to community health is reflected in its numerous initiatives and programs. These programs aim to address various health challenges, including access to healthcare, chronic disease prevention, and health education.

- Health Education and Outreach Programs: BCBS offers a range of health education programs, including workshops, seminars, and online resources, covering topics like diabetes management, heart health, and nutrition. These programs aim to empower individuals to take control of their health and make informed decisions.

- Community Health Centers and Clinics: BCBS supports the development and expansion of community health centers and clinics, ensuring access to affordable healthcare services for underserved populations. These centers provide a range of services, including primary care, dental care, and mental health services.

- Health Equity Initiatives: BCBS recognizes the disparities in healthcare access and outcomes and actively works to address health equity. They support programs that promote health equity by addressing social determinants of health, such as poverty, education, and access to healthy food.

Impact of Community Engagement

BCBS’s community engagement efforts have a significant impact on the health and well-being of communities.

- Improved Health Outcomes: BCBS initiatives have contributed to improved health outcomes, such as reduced rates of chronic diseases and increased access to preventive care.

- Enhanced Community Health: BCBS’s community engagement programs have fostered a healthier environment by promoting healthy lifestyles, addressing health disparities, and supporting community health resources.

- Stronger Communities: BCBS’s commitment to community health has strengthened communities by fostering partnerships, supporting local organizations, and investing in community development initiatives.

BCBS Financial Performance and Stability

Blue Cross Blue Shield (BCBS) is a major player in the U.S. health insurance market, offering coverage to millions of individuals and families. Financial strength and stability are critical for health insurers, ensuring their ability to fulfill their obligations to policyholders. This section examines the financial performance and stability of BCBS, highlighting the factors that contribute to its strength.

Factors Contributing to BCBS Financial Strength

The financial stability of BCBS is underpinned by a combination of factors, including:

- Strong Market Position: BCBS holds a significant market share in many states, providing a stable revenue stream and economies of scale. This strong market presence also allows BCBS to negotiate favorable contracts with healthcare providers.

- Diverse Product Portfolio: BCBS offers a wide range of health insurance products, catering to different needs and budgets. This diversification helps to mitigate risk and stabilize earnings.

- Strong Investment Portfolio: BCBS invests its reserves prudently, generating returns that contribute to financial stability. This includes investing in a mix of assets, such as bonds, stocks, and real estate.

- Efficient Operations: BCBS has a well-established infrastructure and processes, allowing it to manage costs effectively. This includes leveraging technology to automate processes and improve efficiency.

- Regulatory Compliance: BCBS operates in a highly regulated industry, and its compliance with regulations helps to ensure its financial stability. This includes adhering to capital adequacy requirements and other financial reporting standards.

Importance of Financial Stability for Health Insurers

Financial stability is crucial for health insurers for several reasons:

- Ability to Pay Claims: Health insurers are obligated to pay claims when policyholders incur medical expenses. Financial stability ensures that insurers have the resources to meet these obligations.

- Maintaining Coverage: A financially sound insurer can continue to offer health insurance plans, providing access to healthcare for policyholders. Financial instability could lead to coverage disruptions or even bankruptcy.

- Investment in Innovation: Financial stability allows insurers to invest in new technologies and products, improving the quality and efficiency of healthcare services. This can include developing telehealth platforms, data analytics tools, and other innovations.

- Community Impact: Health insurers play a significant role in the health and well-being of communities. Financial stability enables them to support local healthcare initiatives and programs.

BCBS Comparison to Other Health Insurance Providers

Blue Cross Blue Shield (BCBS) is a prominent health insurance provider in the United States, with a vast network and a long history. However, it’s crucial to compare BCBS plans with other major health insurance providers to make informed decisions about your health insurance coverage. This section delves into key differences between BCBS and its competitors, focusing on coverage, costs, and customer service, providing insights for individuals and employers to make informed choices.

Coverage Comparison

The extent of coverage offered by different health insurance providers varies significantly. Understanding the nuances of each provider’s coverage is essential for selecting the plan that best meets your healthcare needs.

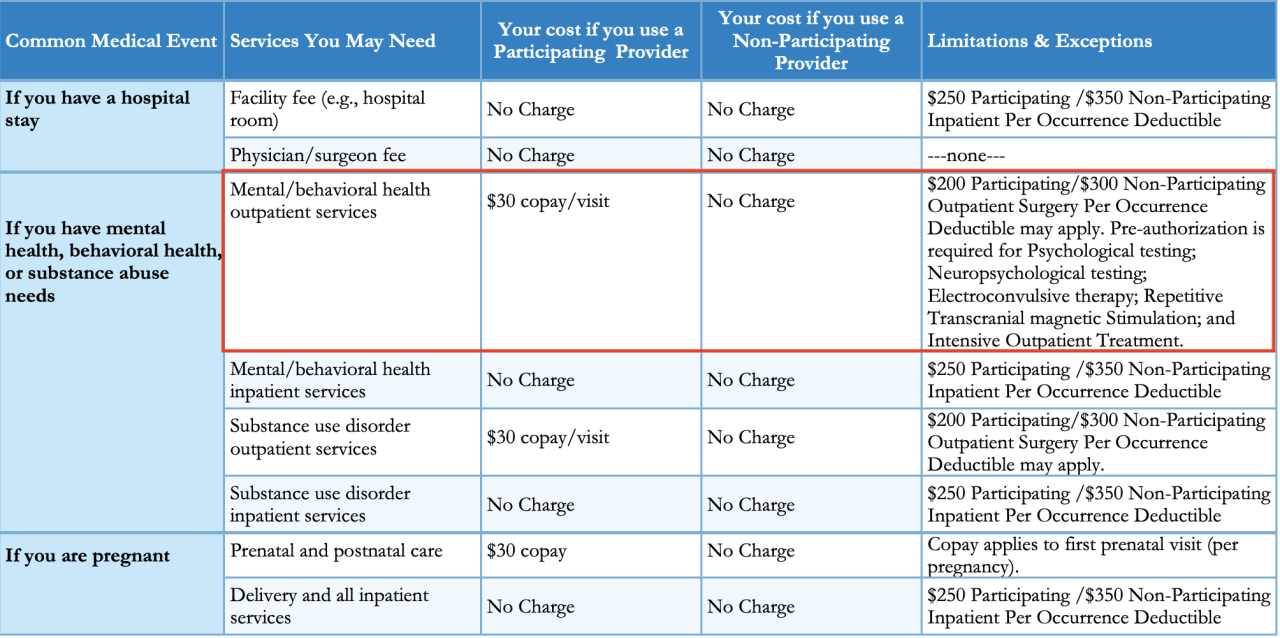

- BCBS: BCBS plans typically offer a comprehensive range of coverage, including hospitalization, surgery, preventive care, and prescription drugs. They also often include coverage for mental health and substance abuse treatment. However, specific coverage details may vary depending on the individual plan and state.

- UnitedHealthcare: UnitedHealthcare, another major provider, also offers comprehensive plans with varying coverage options. Their plans often emphasize preventative care and wellness programs. They may also offer specialized plans for specific demographics, such as seniors or individuals with chronic conditions.

- Anthem: Anthem is another large health insurance provider known for its extensive network of healthcare providers. Their plans typically offer a balance between coverage and affordability. They may also provide access to telehealth services and other digital health resources.

- Cigna: Cigna focuses on providing personalized healthcare solutions. Their plans often feature a strong emphasis on preventative care and wellness programs. They may also offer innovative programs for managing chronic conditions.

- Aetna: Aetna offers a wide range of plans, including HMO, PPO, and POS options. Their plans often emphasize affordability and value. They may also offer programs for managing chronic conditions and improving overall health outcomes.

Cost Comparison

The cost of health insurance is a significant factor for individuals and employers. Understanding the cost structure of different providers can help you make informed decisions about your budget.

- Premiums: BCBS premiums vary depending on factors such as age, location, plan type, and health status. In some areas, BCBS premiums may be higher than other providers, while in other areas, they may be more competitive. It’s essential to compare premiums across different providers to find the best value.

- Deductibles: Deductibles are the amount you pay out of pocket before your health insurance coverage kicks in. BCBS deductibles can vary widely depending on the plan you choose. It’s important to compare deductibles across different providers to determine which plan best suits your budget.

- Co-pays and Co-insurance: Co-pays are fixed amounts you pay for specific services, such as doctor visits or prescriptions. Co-insurance is a percentage of the cost you pay after meeting your deductible. Both co-pays and co-insurance can vary significantly across different providers. It’s essential to understand these cost-sharing arrangements to estimate your out-of-pocket expenses.

Customer Service Comparison

Customer service is an essential aspect of any health insurance plan. You want to ensure that you have access to reliable and responsive support when you need it.

- Accessibility: BCBS typically offers various channels for customer service, including phone, email, and online chat. However, the availability and responsiveness of customer service representatives can vary depending on the time of day and the complexity of your inquiry.

- Response Time: It’s crucial to consider the response time of customer service representatives. Some providers may have faster response times than others. It’s important to factor in this aspect when evaluating customer service quality.

- Resolution Rate: The resolution rate of customer service inquiries is another important factor to consider. You want to ensure that your concerns are addressed promptly and effectively. Researching customer satisfaction ratings and reviews can provide insights into the resolution rate of different providers.

Key Differences Between BCBS and Competitors

- Network Size: BCBS typically has a large network of healthcare providers, which can be advantageous for individuals who prefer to see specific doctors or specialists. However, other providers, such as UnitedHealthcare and Anthem, also have extensive networks.

- Plan Options: BCBS offers a variety of plan options, including HMO, PPO, and POS. However, other providers may offer more specialized plans, such as plans for seniors or individuals with chronic conditions.

- Cost: The cost of BCBS plans can vary depending on the location and plan type. In some areas, BCBS premiums may be higher than other providers, while in other areas, they may be more competitive. It’s essential to compare premiums across different providers to find the best value.

- Customer Service: Customer service experiences can vary depending on the provider and the individual’s specific needs. Researching customer satisfaction ratings and reviews can provide insights into the customer service quality of different providers.

Final Conclusion

Navigating the complex world of health insurance can be daunting, but understanding the nuances of BCBS plans empowers you to make informed decisions. From selecting the right coverage to navigating the network and filing claims, this guide equips you with the knowledge to leverage the benefits of BCBS and secure your healthcare needs.