The cost of car insurance can vary wildly, leaving drivers feeling lost in a sea of options and premiums. Finding the best deal requires a strategic approach, one that involves understanding the factors that influence rates, utilizing comparison platforms, and negotiating with insurers. This guide will equip you with the knowledge and tools to navigate this complex landscape and secure the most favorable coverage for your needs.

By exploring key factors such as driving history, vehicle type, and location, we’ll unravel the intricacies of car insurance pricing. We’ll then delve into the world of online comparison tools, highlighting their benefits and showcasing the best options available. Armed with this knowledge, you’ll be empowered to request quotes from multiple insurers, effectively communicate your needs, and analyze coverage options to find the perfect fit.

Understanding Insurance Rate Factors

Car insurance rates are determined by a complex set of factors that insurers use to assess the risk of insuring a particular driver and vehicle. Understanding these factors can help you make informed decisions about your insurance policy and potentially save money on your premiums.

Factors Influencing Car Insurance Rates

Car insurance rates are influenced by various factors that insurers consider when calculating the risk associated with insuring a particular driver and vehicle. These factors can be broadly categorized into driver-related, vehicle-related, and location-related factors.

- Driver-related factors: These factors pertain to the driver’s personal characteristics and driving history, which directly influence their risk profile. Key driver-related factors include:

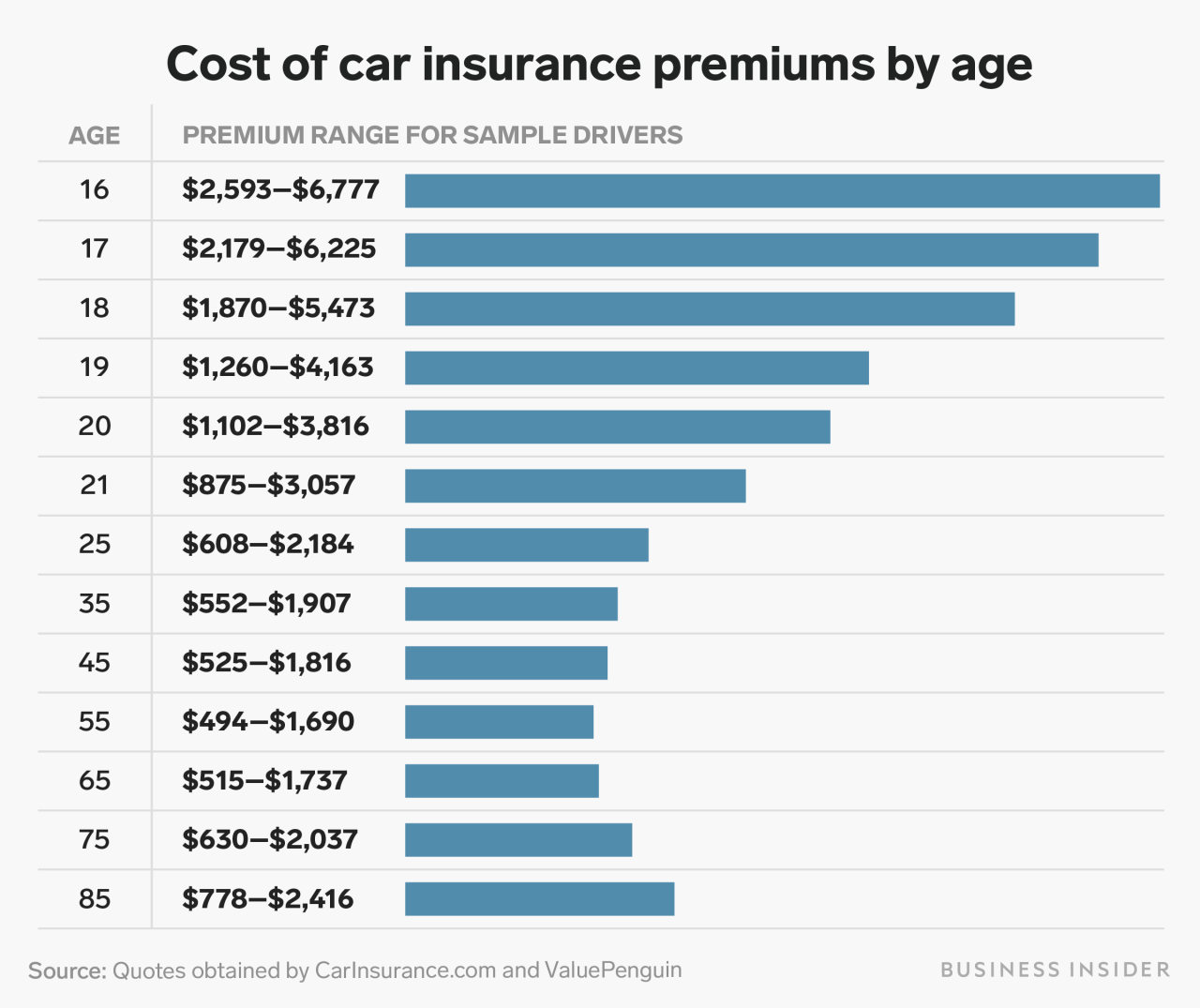

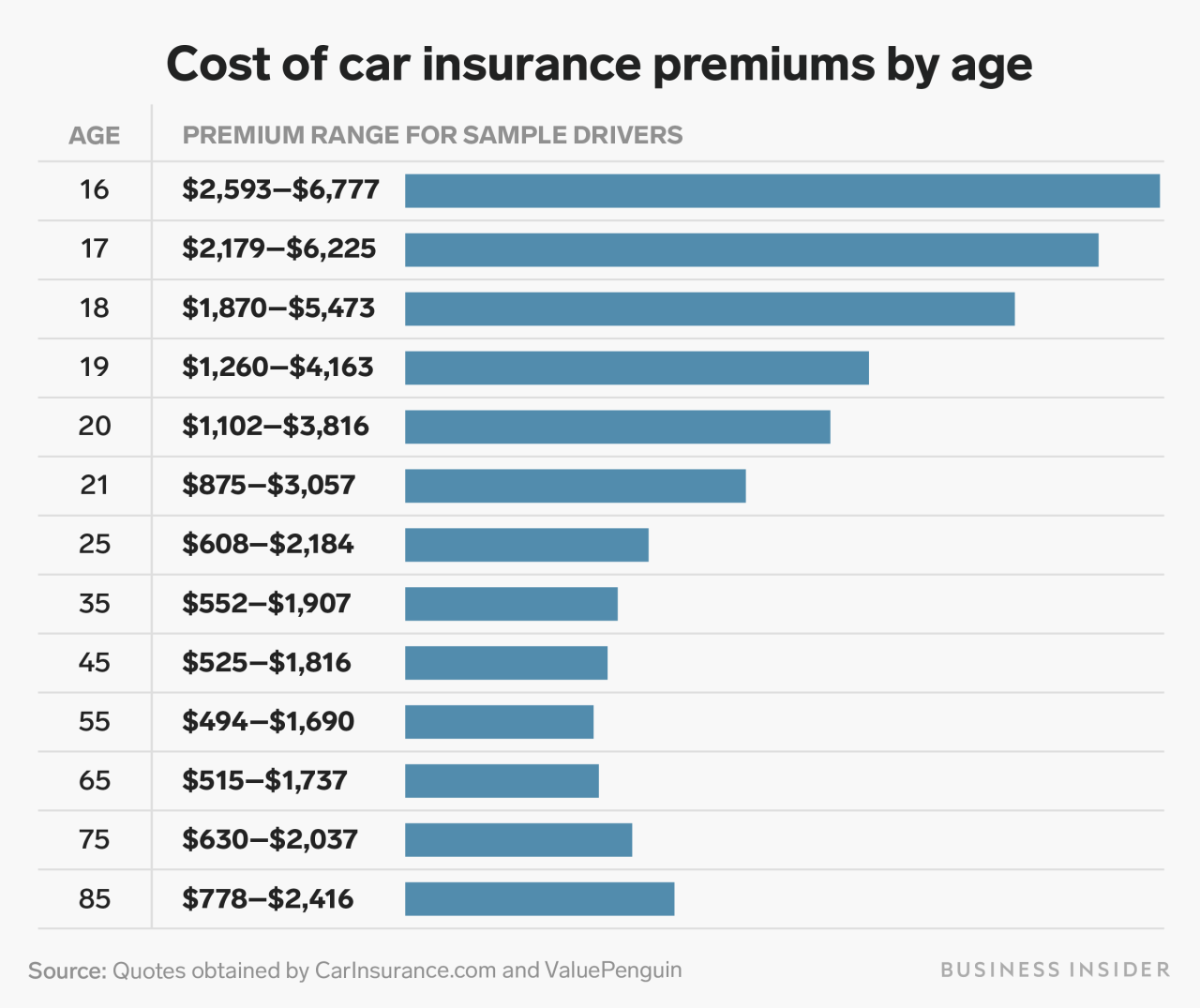

- Age and driving experience: Younger and less experienced drivers tend to have higher accident rates, resulting in higher premiums. As drivers gain experience and age, their premiums generally decrease.

- Driving history: A clean driving record with no accidents or traffic violations will lead to lower premiums. Conversely, a history of accidents or traffic violations will increase premiums.

- Credit score: Insurers may use credit score as a proxy for risk assessment, with higher credit scores often associated with lower premiums. This is because individuals with good credit history tend to be more responsible and financially stable.

- Driving habits: Factors such as the number of miles driven annually, driving location (urban vs. rural), and time of day driving can influence rates. For example, drivers who commute long distances or drive frequently in high-traffic areas may face higher premiums.

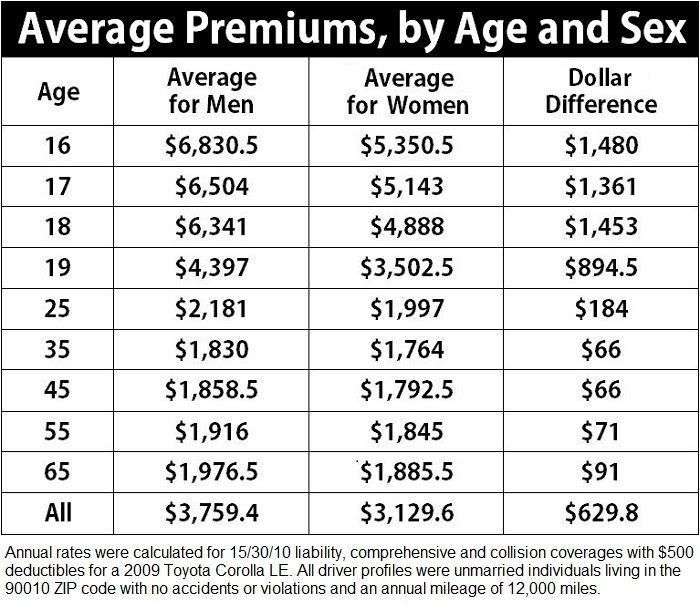

- Gender: In some regions, gender can influence rates, with women generally paying lower premiums than men. This is because women tend to have lower accident rates than men.

- Marital status: Married individuals may receive lower premiums than single individuals, as married drivers are statistically less likely to be involved in accidents.

- Education level: Higher education levels are sometimes associated with lower insurance rates, as educated drivers may have a better understanding of road safety and are more likely to make responsible driving decisions.

- Vehicle-related factors: These factors relate to the characteristics of the insured vehicle, including its make, model, year, safety features, and value. Key vehicle-related factors include:

- Make and model: Some car models are known for their safety features and reliability, leading to lower premiums. Conversely, models with a history of frequent accidents or theft may have higher premiums.

- Year of manufacture: Newer cars generally have more advanced safety features and are less likely to be involved in accidents, resulting in lower premiums. Older cars, on the other hand, may have higher premiums due to their increased risk of breakdowns and safety concerns.

- Safety features: Vehicles equipped with safety features such as anti-lock brakes, airbags, and stability control are generally considered safer and may qualify for discounts on premiums.

- Value of the vehicle: More expensive vehicles typically have higher premiums because they cost more to repair or replace in case of an accident.

- Engine size and horsepower: Vehicles with larger engines and higher horsepower may have higher premiums, as they are generally considered more powerful and potentially riskier to drive.

- Location-related factors: These factors pertain to the geographic location where the vehicle is insured, including the state, city, and neighborhood. Key location-related factors include:

- State laws and regulations: Different states have varying insurance requirements and regulations, which can influence premiums. For example, states with mandatory insurance coverage may have higher premiums compared to states with optional coverage.

- Population density and traffic volume: Areas with high population density and heavy traffic tend to have higher accident rates, leading to higher premiums. Conversely, rural areas with lower traffic volumes may have lower premiums.

- Crime rates: Areas with higher crime rates, including car theft, may have higher premiums due to the increased risk of vehicle theft or damage.

- Weather conditions: Areas with extreme weather conditions, such as hurricanes, tornadoes, or heavy snowfall, may have higher premiums due to the increased risk of vehicle damage.

Illustrative Examples of Varying Rates

To illustrate how different factors can lead to varying rates for the same car, consider the following scenarios:

- Scenario 1: Two individuals, both 25 years old, own the same 2020 Honda Civic. However, one individual has a clean driving record with no accidents or violations, while the other has been involved in two accidents in the past three years. The individual with the clean driving record will likely receive a lower premium than the individual with a history of accidents.

- Scenario 2: Two individuals, both 35 years old with clean driving records, own the same 2018 Toyota Camry. However, one individual lives in a densely populated urban area with high traffic volume, while the other lives in a rural area with low traffic volume. The individual living in the urban area will likely face a higher premium due to the increased risk of accidents in high-traffic areas.

- Scenario 3: Two individuals, both 40 years old with clean driving records, own different vehicles. One individual owns a 2019 Ford Mustang with a powerful engine and a sporty design, while the other owns a 2019 Honda Accord with a standard engine and a more conservative design. The individual with the Mustang will likely face a higher premium due to the higher risk associated with a more powerful and sporty vehicle.

Comparison Platforms and Tools

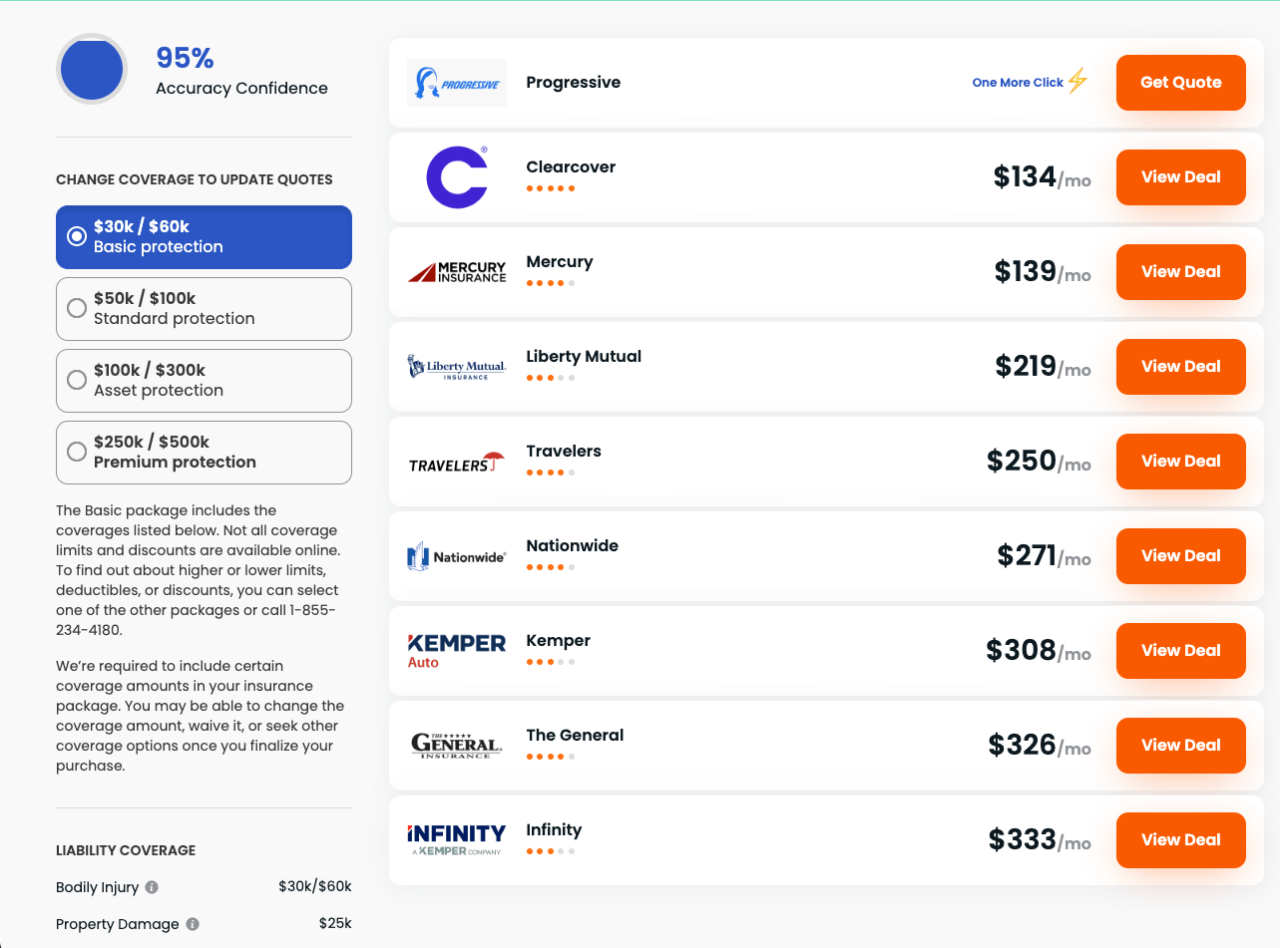

In today’s digital age, comparing car insurance rates is easier than ever. Online comparison platforms have revolutionized the process, offering consumers a convenient and efficient way to find the best deals. These platforms allow you to compare quotes from multiple insurers simultaneously, saving you time and effort.

Benefits of Using Online Comparison Platforms

Online comparison platforms offer numerous benefits for car insurance shoppers, including:

- Convenience: Instead of contacting multiple insurers individually, you can get quotes from several insurers within minutes, all from the comfort of your home or office. This saves you time and effort, especially if you are busy with other commitments.

- Efficiency: Comparison platforms streamline the quote process by gathering your basic information once and automatically submitting it to multiple insurers. This eliminates the need for repetitive information entry and reduces the time it takes to get quotes.

- Transparency: Online platforms provide clear and concise information about each insurer’s coverage options, pricing, and terms and conditions. This transparency helps you make informed decisions based on your individual needs and budget.

- Potential Savings: By comparing quotes from multiple insurers, you can often find better rates than you would by contacting insurers individually. This is because platforms use algorithms to analyze your information and identify the best deals based on your profile.

Comparison of Popular Comparison Websites

Several popular comparison websites offer car insurance quotes. Some of the most prominent include:

- Compare.com: This platform allows users to compare quotes from over 20 insurers, including well-known brands like Geico, Progressive, and State Farm. It offers a user-friendly interface and provides detailed information about each insurer’s coverage options. Compare.com also features a dedicated section for finding car insurance discounts.

- The Zebra: The Zebra is known for its comprehensive comparison tool, which allows users to compare quotes from over 50 insurers. It offers a wide range of coverage options, including liability, collision, comprehensive, and uninsured motorist coverage. The Zebra also provides insights into each insurer’s financial strength and customer satisfaction ratings.

- Insurify: Insurify distinguishes itself by offering personalized recommendations based on your specific needs and driving history. It uses an advanced algorithm to analyze your information and identify the best deals from a network of over 20 insurers. Insurify also offers a “SmartQuote” feature that helps you understand your coverage options and potential savings.

Key Features and Pros/Cons of Popular Comparison Platforms

The following table summarizes the key features and pros and cons of some popular comparison platforms:

| Platform | Key Features | Pros | Cons |

|---|---|---|---|

| Compare.com | – Quotes from over 20 insurers – User-friendly interface – Dedicated section for discounts |

– Wide range of insurers – Easy to use – Comprehensive information |

– Limited customization options – May not always offer the lowest rates |

| The Zebra | – Quotes from over 50 insurers – Comprehensive coverage options – Financial strength and customer satisfaction ratings |

– Extensive insurer network – Detailed information about each insurer – Independent ratings |

– Can be overwhelming for some users – May require more time to compare quotes |

| Insurify | – Personalized recommendations – SmartQuote feature – Network of over 20 insurers |

– Tailored quotes – Helpful insights into coverage options – Potential for significant savings |

– May not always include all insurers – Requires more personal information |

Obtaining Quotes from Insurers

Securing competitive car insurance quotes is a crucial step in finding the best coverage for your needs and budget. The process involves gathering information about your vehicle, driving history, and personal details, then submitting it to multiple insurers.

Steps to Obtain Car Insurance Quotes

The process of obtaining quotes from different insurers is relatively straightforward. Here’s a step-by-step guide:

- Gather Essential Information: Before you begin, collect all the necessary information about your vehicle, driving history, and personal details. This will help you provide accurate information to insurers and receive accurate quotes.

- Select Insurers to Contact: Choose a range of insurers to get quotes from. Consider factors like reputation, customer service, and coverage options. You can research online, ask for recommendations, or use comparison websites.

- Fill Out Quote Forms: Most insurers offer online quote forms, making the process quick and convenient. You can also request quotes over the phone or in person. Be sure to provide accurate information and answer all questions truthfully.

- Compare Quotes: Once you have received quotes from multiple insurers, carefully compare them side-by-side. Consider factors like premium, coverage, deductibles, and discounts.

- Choose the Best Option: Select the insurance policy that best meets your needs and budget. Remember to consider factors beyond price, such as customer service, claims handling, and coverage options.

Checklist of Essential Information

To obtain accurate car insurance quotes, you need to provide insurers with specific information. Here’s a checklist:

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number), mileage, and estimated value.

- Driving History: Driving record, including any accidents, violations, or suspensions.

- Personal Information: Name, address, date of birth, contact information, and employment details.

- Coverage Preferences: Desired coverage levels, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Other Relevant Details: Any discounts you qualify for, such as good driver discounts, safe driver discounts, or multi-car discounts.

Communicating Your Needs Effectively

Clearly communicating your needs to insurers can help you get more personalized quotes. Here are some tips:

- Be Specific: Provide detailed information about your driving habits, parking location, and any other relevant factors that might influence your insurance rate.

- Ask Questions: Don’t hesitate to ask questions about coverage options, discounts, and other aspects of the policy.

- Be Honest: Provide accurate information to avoid surprises later.

- Shop Around: Getting quotes from multiple insurers can help you find the best value for your money.

Analyzing Coverage Options

Car insurance offers a range of coverage options, each designed to protect you financially in different scenarios. Understanding the nuances of these options is crucial to selecting a policy that aligns with your individual needs and budget.

Understanding Different Coverage Types

The most common types of car insurance coverage include:

- Liability Coverage: This is the most basic type of insurance, and it is generally required by law. Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other party’s medical bills, lost wages, and property damage up to the limits of your policy.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision, regardless of who is at fault. If you have a car loan or lease, your lender may require you to carry collision coverage.

- Comprehensive Coverage: This coverage protects your vehicle against damage from non-collision events, such as theft, vandalism, fire, hail, or natural disasters. Like collision coverage, it pays for repairs or replacement up to the actual cash value of your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. It covers your medical bills, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It is typically required in some states.

- Medical Payments Coverage (Med Pay): This coverage pays for your medical expenses, regardless of who is at fault in an accident. It is typically a supplemental coverage that can be added to your policy.

Benefits and Drawbacks of Coverage Options

Each type of coverage has its own set of benefits and drawbacks.

- Liability Coverage:

- Benefit: It is a legal requirement in most states, providing essential protection against financial ruin if you cause an accident.

- Drawback: It only covers the other party’s damages, not your own.

- Collision Coverage:

- Benefit: It provides peace of mind knowing your vehicle will be repaired or replaced after a collision.

- Drawback: It can be expensive, especially for newer vehicles.

- Comprehensive Coverage:

- Benefit: It protects your vehicle against a wide range of non-collision risks.

- Drawback: It may not be necessary if you have an older vehicle with low value.

- Uninsured/Underinsured Motorist Coverage:

- Benefit: It provides crucial protection in cases where the other driver is uninsured or underinsured.

- Drawback: It is not always required by law, so you may need to purchase it separately.

- Personal Injury Protection (PIP):

- Benefit: It covers your medical expenses and lost wages, regardless of fault.

- Drawback: It can be expensive, and the benefits may be limited.

- Medical Payments Coverage (Med Pay):

- Benefit: It provides supplemental coverage for medical expenses, even if you are not at fault.

- Drawback: It may not cover all medical expenses, and it is a supplemental coverage that can be expensive.

Comparing Coverage Options

The best coverage options for you will depend on your individual circumstances, including your driving history, the value of your vehicle, and your financial situation. Here is a table that summarizes the key coverage options and their relevance to different drivers:

| Coverage Type | Cost | Relevance to Drivers |

|---|---|---|

| Liability Coverage | Low | Essential for all drivers. |

| Collision Coverage | High (for newer vehicles) | Recommended for drivers with car loans or leases, or for those who drive newer vehicles. |

| Comprehensive Coverage | Moderate | Recommended for drivers with newer vehicles or those who live in areas prone to natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Moderate | Recommended for all drivers, as it provides protection against uninsured or underinsured drivers. |

| Personal Injury Protection (PIP) | High | Required in some states, and may be beneficial for drivers who are concerned about medical expenses and lost wages. |

| Medical Payments Coverage (Med Pay) | Low | Supplemental coverage that can be helpful for drivers who want additional medical expense coverage. |

Discounts and Savings

Lowering your car insurance premiums can be a significant financial benefit. Fortunately, insurance companies offer various discounts to help you save money. Understanding these discounts and how to qualify for them can significantly reduce your overall insurance costs.

Common Car Insurance Discounts

Discounts are a valuable tool for lowering your car insurance premiums. These discounts can vary depending on the insurance company, your driving history, and other factors.

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, typically without accidents or traffic violations for a specific period. For instance, a driver with five years of accident-free driving may qualify for a 10% discount.

- Safe Driver Discount: Similar to the good driver discount, this discount is awarded to drivers who have completed a defensive driving course. These courses teach safe driving techniques and can reduce your insurance premium by up to 10%.

- Multi-Car Discount: Insuring multiple vehicles with the same insurance company often results in a discount. The discount percentage can vary depending on the number of vehicles and the insurance company. For example, a family with two cars might receive a 15% discount on their total premium.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, with the same company can lead to significant savings. The discount can range from 5% to 20% depending on the policies and the insurer.

- Anti-theft Device Discount: Installing anti-theft devices like alarms, immobilizers, or GPS tracking systems can make your car less attractive to thieves and lower your insurance premium. Discounts can range from 5% to 15% depending on the device and the insurer.

- Loyalty Discount: Insurance companies often reward long-term customers with loyalty discounts. These discounts are usually offered after a certain number of years of continuous coverage. For example, a driver who has been insured for 10 years might receive a 5% discount.

- Student Discount: Good students with high GPAs or those attending college may qualify for discounts. This discount reflects the perception that these students are responsible and less likely to be involved in accidents.

- Pay-in-Full Discount: Some insurers offer discounts for paying your premium in full upfront instead of making monthly payments. This saves the insurer administrative costs and may lead to a discount of 5% or more.

Maximizing Discounts and Savings

Taking advantage of all available discounts can significantly reduce your insurance costs. Here are some tips:

- Maintain a Clean Driving Record: Avoid accidents and traffic violations. These incidents can lead to higher premiums and make you ineligible for discounts.

- Complete a Defensive Driving Course: Enroll in a recognized defensive driving course to improve your driving skills and potentially qualify for a safe driver discount.

- Bundle Your Insurance Policies: Combine your car insurance with other policies like homeowners or renters insurance to qualify for multi-policy discounts.

- Install Anti-theft Devices: Consider installing anti-theft devices to enhance your car’s security and potentially receive a discount.

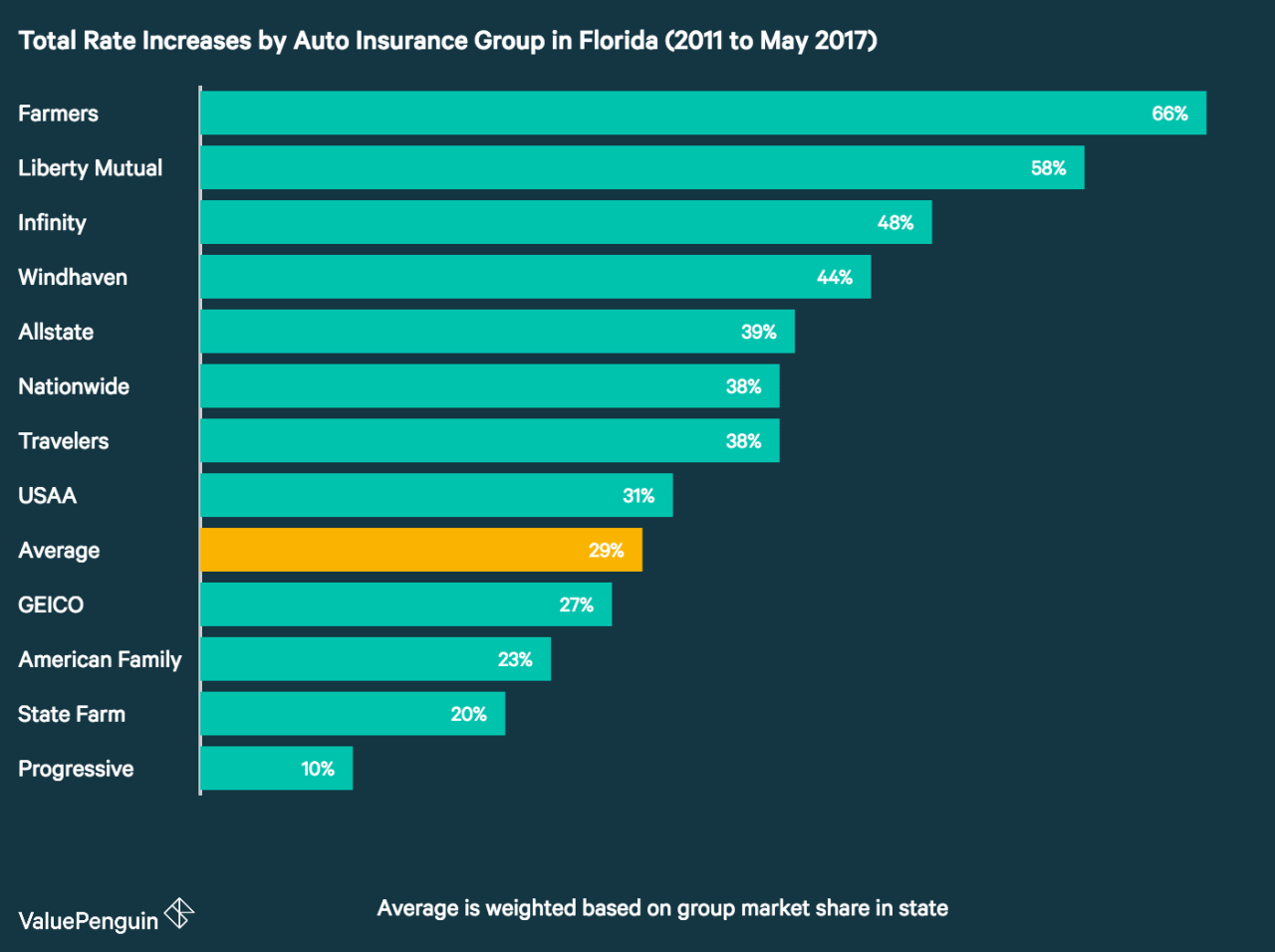

- Compare Quotes from Multiple Insurers: Get quotes from different insurance companies to find the best rates and discounts. Online comparison platforms can help you quickly and easily compare quotes from multiple insurers.

- Negotiate with Your Insurer: After comparing quotes, you can negotiate with your current insurer to see if they can match or beat the rates offered by other companies. Be prepared to highlight the discounts you qualify for and the factors that make you a low-risk driver.

- Review Your Policy Regularly: Periodically review your insurance policy to ensure you’re still eligible for all applicable discounts and that your coverage meets your current needs. You may be able to adjust your coverage and reduce your premium without compromising your protection.

Policy Features and Add-ons

Beyond basic coverage, car insurance policies offer a range of optional features and add-ons that can enhance your protection and provide peace of mind. These features can vary widely in price and value, making it essential to carefully consider your individual needs and driving habits when choosing them.

Understanding the different policy features and add-ons available is crucial for making informed decisions about your insurance coverage. By comparing and contrasting these features, you can tailor your policy to meet your specific requirements and potentially save money on premiums.

Common Policy Features and Their Value

A comprehensive understanding of common policy features is essential for selecting the right insurance coverage. This section Artikels some of the most frequently encountered features, their associated costs, and their value to drivers.

| Feature | Cost | Value |

|---|---|---|

| Roadside Assistance | Varies depending on the level of coverage and the insurer | Provides assistance in case of breakdowns, flat tires, and other emergencies. This can be particularly valuable for drivers who frequently travel long distances or live in remote areas. |

| Rental Car Coverage | Varies depending on the coverage limits and the insurer | Covers the cost of a rental car if your vehicle is damaged or stolen and you are unable to drive it. This can be helpful for drivers who rely on their vehicles for work or daily errands. |

| Gap Coverage | Varies depending on the amount of coverage and the insurer | Covers the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled. This can be particularly valuable for drivers who have financed or leased their vehicles. |

| Loan/Lease Coverage | Varies depending on the amount of coverage and the insurer | Covers the cost of repairing or replacing your vehicle if it is damaged or stolen. This can be helpful for drivers who have financed or leased their vehicles. |

Roadside Assistance

Roadside assistance is a common policy feature that provides help in case of breakdowns, flat tires, and other emergencies. It typically includes services such as:

- Towing

- Jump starts

- Flat tire changes

- Fuel delivery

- Lockout assistance

The cost of roadside assistance varies depending on the level of coverage and the insurer. Some policies offer basic roadside assistance, while others provide more comprehensive coverage, such as towing up to a certain distance or providing a rental car if your vehicle is disabled.

Rental Car Coverage

Rental car coverage provides temporary transportation if your vehicle is damaged or stolen and you are unable to drive it. It typically covers the cost of a rental car up to a certain limit.

The cost of rental car coverage varies depending on the coverage limits and the insurer. Some policies offer basic rental car coverage, while others provide more comprehensive coverage, such as covering the cost of a rental car for a longer period or providing a higher daily rental allowance.

Gap Coverage

Gap coverage, also known as loan/lease gap insurance, covers the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled. This can be particularly valuable for drivers who have financed or leased their vehicles, as the actual cash value of a vehicle often depreciates faster than the amount owed on a loan or lease.

For example, if you financed a vehicle for $25,000 and it is totaled in an accident, the insurance company may only pay you $15,000 for the actual cash value of the vehicle. With gap coverage, the insurance company would pay the remaining $10,000 to cover the difference between the actual cash value and the amount you owe on the loan.

Loan/Lease Coverage

Loan/lease coverage, also known as collision and comprehensive coverage, covers the cost of repairing or replacing your vehicle if it is damaged or stolen. This coverage is typically required by lenders or lessors if you have financed or leased your vehicle.

The cost of loan/lease coverage varies depending on the amount of coverage and the insurer. Some policies offer basic loan/lease coverage, while others provide more comprehensive coverage, such as covering the cost of repairs or replacement for a longer period or providing a higher coverage limit.

Understanding Policy Documents

Car insurance policies are legal contracts that Artikel the terms and conditions of your coverage. Understanding these documents is crucial for ensuring you have the protection you need and for navigating any potential claims.

Key Sections and Information

The key sections of a car insurance policy typically include:

- Declarations: This section contains basic information about the policyholder, vehicle, and coverage details, including policy number, effective dates, and premium amount.

- Coverages: This section Artikels the specific types of coverage you have purchased, such as liability, collision, comprehensive, and uninsured motorist coverage. It also details the limits and exclusions of each coverage.

- Exclusions: This section specifies circumstances or events that are not covered by the policy. For example, damage caused by wear and tear, intentional acts, or driving under the influence.

- Conditions: This section Artikels the policyholder’s responsibilities, such as reporting accidents, cooperating with investigations, and maintaining the insured vehicle. It also details the insurer’s responsibilities, such as paying claims and providing legal defense.

- Definitions: This section provides definitions of key terms used in the policy, ensuring clarity and understanding.

Importance of Reviewing and Understanding Policy Terms and Conditions

Thoroughly reviewing and understanding your policy terms and conditions is essential for several reasons:

- Knowing Your Coverage: You need to understand the extent of your coverage to make informed decisions about your insurance needs and ensure you have adequate protection.

- Avoiding Unexpected Costs: Policy exclusions and limitations can result in unexpected costs if you are unaware of them.

- Ensuring Fair Claims Handling: Understanding your policy terms can help you navigate the claims process and ensure fair treatment from your insurer.

- Identifying Potential Issues: Reviewing your policy can help identify potential issues or ambiguities that could lead to disputes later.

Identifying Potential Issues or Ambiguities

While insurance policies are designed to be comprehensive, there can sometimes be ambiguities or inconsistencies. When reviewing your policy, consider the following:

- Read Carefully: Pay close attention to all sections of the policy, including the fine print.

- Seek Clarification: If you encounter any unclear terms or conditions, don’t hesitate to contact your insurer for clarification.

- Compare Policies: Compare your policy to other insurance policies to see how your coverage stacks up.

- Consult a Professional: If you have concerns about your policy or if you believe there are potential issues, consult with an insurance professional or attorney.

The Importance of Regular Reviews

Car insurance policies are not static. Your needs and circumstances can change over time, which means your insurance policy may no longer be the most appropriate or cost-effective. Regular reviews are crucial to ensure your policy aligns with your current situation and provides the best value.

Benefits of Regular Reviews

Regularly reviewing your car insurance policy can lead to significant savings and ensure you have the right coverage. Here are some key benefits:

- Cost Savings: Your insurance premiums can fluctuate based on factors like your driving record, vehicle value, and even your credit score. A review can identify potential discounts you might be eligible for, helping you save money on your premiums.

- Coverage Adequacy: As your life changes, your insurance needs might evolve too. A review ensures your policy provides adequate coverage for your current circumstances, such as a new car, a family expansion, or an increase in your assets.

- Policy Updates: Insurance companies frequently update their policies and introduce new features. A review helps you stay informed about these changes and ensure your policy remains current and competitive.

Situations That Necessitate a Policy Review

There are several scenarios that might prompt a policy review:

- Changes in Driving Habits: If you start driving less frequently, commute shorter distances, or switch to a safer vehicle, your insurance premiums might be eligible for adjustments.

- Changes in Vehicle Ownership: Acquiring a new car or selling your existing vehicle requires a policy review to reflect the new situation and ensure appropriate coverage.

- Changes in Personal Circumstances: Life events like marriage, childbirth, or a change in residence can affect your insurance needs and premiums.

- Significant Changes in Driving Record: A recent accident, traffic violation, or completion of a defensive driving course can impact your premiums. A review can help you understand these changes and explore options for mitigating their impact.

- Increase in Assets: As your assets grow, it’s crucial to ensure your insurance coverage is adequate to protect your investments. A review can help you assess your coverage needs and adjust your policy accordingly.

Negotiating with Insurers

While regular reviews are important, knowing how to negotiate with insurers can further optimize your policy:

- Gather Information: Before contacting your insurer, gather information about your current policy, including premiums, coverage details, and any discounts you’re receiving. This will equip you to make informed decisions and negotiate effectively.

- Compare Quotes: Obtain quotes from multiple insurers to understand the market rates for your specific needs. This provides a benchmark for negotiating with your current insurer.

- Highlight Your Driving Record: If you have a clean driving record, emphasize it to your insurer. A good driving history can often lead to lower premiums.

- Explore Discounts: Ask about any discounts you might be eligible for, such as safe driver discounts, multi-car discounts, or good student discounts. Many insurers offer a range of discounts that can significantly reduce your premiums.

- Be Prepared to Switch: If your current insurer is unwilling to negotiate or offer competitive rates, be prepared to switch to another insurer. This can often prompt your current insurer to reconsider their offer.

Choosing the Right Insurance Provider

Selecting the right car insurance provider is crucial for ensuring adequate coverage and peace of mind. While price is a primary consideration, it’s important to weigh other factors to make an informed decision.

Reputation and Customer Service

A provider’s reputation and customer service are essential indicators of their reliability and commitment to customer satisfaction.

- Read reviews and ratings: Reputable websites like J.D. Power and Consumer Reports provide independent assessments of insurance companies based on customer feedback. These platforms offer insights into customer satisfaction, claims handling, and overall experience.

- Check for awards and recognitions: Look for awards or recognitions from industry organizations, which can indicate a company’s commitment to excellence.

- Consider customer service channels: Assess the availability and responsiveness of customer service channels, such as phone, email, and online chat.

Financial Stability

A financially stable insurer is more likely to be able to pay claims when needed.

- Check credit ratings: Agencies like A.M. Best and Standard & Poor’s provide financial strength ratings for insurance companies. A high rating indicates strong financial stability.

- Research claims-paying history: Look for information about the insurer’s history of paying claims promptly and fairly.

Coverage Options and Features

Different insurance providers offer varying coverage options and features.

- Compare coverage types: Consider the different types of coverage available, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Evaluate optional features: Assess the value of optional features like roadside assistance, rental car reimbursement, and accident forgiveness.

Discounts and Savings

Many insurers offer discounts to reduce premiums.

- Inquire about available discounts: Ask about discounts for good driving records, safety features, multiple policies, and affiliations with certain organizations.

- Consider bundling policies: Bundling your car insurance with other policies, such as home or renters insurance, can often result in significant savings.

Personalized Needs and Preferences

Ultimately, the best insurance provider for you depends on your individual needs and preferences.

- Prioritize your needs: Determine what factors are most important to you, such as price, coverage, customer service, or financial stability.

- Seek personalized recommendations: Consult with an insurance agent or broker who can provide personalized recommendations based on your specific requirements.

Tips for Saving on Car Insurance

Saving money on car insurance is a priority for many drivers. By implementing strategic measures, you can significantly reduce your premiums while maintaining adequate coverage. This section explores practical tips and strategies for lowering your car insurance costs, highlighting the impact of driving habits, vehicle maintenance, and location on premiums.

Driving Habits

Your driving habits significantly influence your insurance rates. Insurance companies assess your risk profile based on factors like your driving record, age, and driving experience.

- Maintain a Clean Driving Record: Traffic violations, accidents, and speeding tickets can significantly increase your premiums. Avoid risky driving behaviors and strive for a clean driving record.

- Consider Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices and may earn you a discount on your insurance.

- Limit Your Mileage: If you drive less frequently, consider informing your insurer. Some companies offer discounts for low-mileage drivers.

- Avoid Distracted Driving: Distracted driving, such as using a mobile phone while driving, increases your risk of accidents. Focus on the road and avoid distractions.

Vehicle Maintenance

Maintaining your vehicle in good condition can impact your insurance premiums. Insurance companies often offer discounts for vehicles with safety features and those that are well-maintained.

- Install Safety Features: Consider installing safety features such as anti-theft devices, airbags, and anti-lock brakes. These features can reduce your risk of accidents and may qualify you for discounts.

- Regular Servicing: Ensure your vehicle receives regular maintenance, including oil changes, tire rotations, and brake inspections. This helps prevent breakdowns and accidents, potentially lowering your premiums.

Location

Your location can significantly impact your car insurance rates. Factors such as the density of traffic, crime rates, and the prevalence of accidents in your area influence premiums.

- Urban vs. Rural Areas: Insurance rates are generally higher in urban areas due to increased traffic congestion and higher risk of accidents.

- Consider Parking Options: If you park your car in a garage or a secure location, inform your insurer. This may qualify you for a discount, as it reduces the risk of theft or damage.

Negotiating Rates

Don’t hesitate to negotiate your car insurance rates.

- Shop Around: Compare quotes from multiple insurers to find the best rates.

- Bundle Policies: Consider bundling your car insurance with other policies, such as homeowners or renters insurance. This can often result in significant savings.

- Ask for Discounts: Inquire about available discounts, such as good student discounts, safe driver discounts, and multi-car discounts.

Alternative Coverage Options

Explore alternative coverage options to potentially reduce your premiums.

- Higher Deductibles: Consider increasing your deductible. This can lower your monthly premiums, but you will have to pay more out-of-pocket in case of an accident.

- Reduced Coverage: If you have an older car with a lower value, you may consider reducing your coverage, such as collision and comprehensive coverage.

Epilogue

Ultimately, securing the best car insurance rate is about being informed, proactive, and strategic. By understanding the factors that influence premiums, leveraging comparison platforms, and engaging in thoughtful negotiation, you can achieve significant savings while ensuring comprehensive protection. Remember, car insurance is not a one-size-fits-all solution. By taking the time to research, compare, and personalize your coverage, you can gain peace of mind and keep your wallet happy.