In the world of auto insurance, where coverage options are as diverse as the vehicles themselves, liability only auto insurance stands out as a unique and often misunderstood choice. This bare-bones approach to insurance offers the minimum legal protection, leaving drivers exposed to significant financial risks in the event of an accident. But for the right individual, it can be a budget-friendly solution, allowing them to save on premiums while still meeting the legal requirements for driving.

This article delves into the intricacies of liability only auto insurance, exploring its pros and cons, suitability, and the potential pitfalls of relying solely on this minimal coverage. We’ll dissect the coverage details, cost considerations, and legal implications, equipping you with the knowledge to make an informed decision about whether this type of insurance is the right fit for your specific needs.

What is Liability Only Auto Insurance?

Liability-only auto insurance, sometimes referred to as “bare bones” or “state minimum” coverage, is the most basic form of auto insurance. It’s designed to protect you financially if you’re at fault in an accident that causes damage to another person’s property or injuries to another person.

Liability-only insurance is a legal requirement in most states, with each state setting minimum coverage limits. It’s essential for drivers to understand the coverage provided by liability-only insurance and how it differs from full coverage auto insurance.

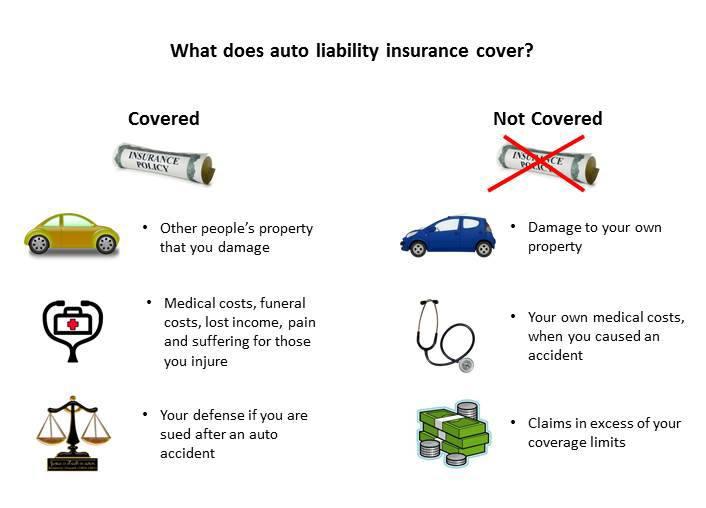

Coverage Provided by Liability-Only Insurance

Liability-only insurance primarily covers the following:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages incurred by the other driver and passengers in the event of an accident where you are at fault.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other damaged property in an accident where you are at fault.

Liability-only insurance does not cover damages to your own vehicle, injuries to yourself, or any other costs associated with your vehicle.

Liability-Only Insurance vs. Full Coverage Auto Insurance

Liability-only insurance is significantly different from full coverage auto insurance. Full coverage auto insurance includes additional coverage options, such as:

- Collision Coverage: Pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: Pays for damages to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

While full coverage insurance provides more comprehensive protection, it also comes at a higher cost. Liability-only insurance is a more affordable option, but it offers less protection.

It’s important to weigh the risks and costs when deciding whether liability-only insurance is right for you.

Who Needs Liability Only Auto Insurance?

Liability-only auto insurance, also known as “bare bones” or “state minimum” coverage, is a cost-effective option for certain drivers. However, it’s crucial to understand the financial and risk implications before making a decision.

Liability-only auto insurance is suitable for individuals who prioritize affordability and have minimal assets to protect. It’s often a good choice for drivers who:

Financial Implications of Liability Only Insurance

Choosing liability-only insurance can significantly reduce your annual premiums. However, it’s essential to weigh this cost savings against the potential financial risks. In the event of an accident, you will be responsible for covering any damages to your own vehicle, medical expenses, and other losses.

Comparing the Risks of Liability Only and Full Coverage

Liability-only insurance provides basic protection by covering the other party’s damages, but it leaves you vulnerable to substantial financial losses if your vehicle is damaged or you are injured in an accident. Full coverage, on the other hand, offers comprehensive protection, including collision and comprehensive coverage.

- Liability-only insurance: This option provides coverage for the other party’s damages, including property damage and bodily injury, but does not cover your own vehicle’s repairs or your medical expenses.

- Full coverage: This option includes liability coverage, as well as collision and comprehensive coverage, which protects your own vehicle against damages from accidents and non-collision events, such as theft or vandalism.

The decision between liability-only and full coverage depends on your individual circumstances, including the value of your vehicle, your financial situation, and your risk tolerance.

Liability Only Insurance Coverage Details

Liability-only auto insurance provides coverage for damages you cause to others in an accident, but it doesn’t cover damage to your own vehicle. It’s a bare-bones option that can be cost-effective for drivers with older cars or those who want to minimize their premiums.

Coverage Limits

Liability-only insurance typically includes two primary coverage limits: bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering for the other driver and passengers if you’re at fault in an accident. It’s usually expressed as a per-person limit and a per-accident limit, such as 25/50, which means $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for damage to the other driver’s vehicle or property if you’re at fault in an accident. It’s typically expressed as a single limit, such as $25,000, which means the maximum amount your insurance will pay for property damage in any one accident.

Legal Implications of Insufficient Liability Coverage

If you’re found at fault in an accident and your liability coverage is insufficient to cover the damages, you could be held personally liable for the remaining amount. This means you could be sued by the other driver and forced to pay the difference out of your own pocket. In some cases, this could even lead to bankruptcy.

Examples of Situations Where Liability Only Insurance Would Cover Damages

- Rear-ending Another Vehicle: If you rear-end another vehicle and cause damage to their car or injuries to the driver or passengers, your liability-only insurance would cover the damages to the other vehicle and any medical expenses for the other driver and passengers.

- Hitting a Pedestrian: If you hit a pedestrian while driving and cause injuries, your liability-only insurance would cover the pedestrian’s medical expenses and lost wages.

- Damaging a Parked Car: If you accidentally hit a parked car and cause damage, your liability-only insurance would cover the repairs to the parked car.

Cost and Savings of Liability Only Insurance

Liability-only auto insurance can significantly reduce your premiums compared to full coverage, making it an attractive option for some drivers. However, understanding how these premiums are calculated and the factors that influence them is crucial to making an informed decision.

Calculating Liability Only Insurance Premiums

Liability-only insurance premiums are determined by several factors, including your driving history, age, location, and the type of vehicle you drive.

The primary factor influencing your premium is your driving history.

A clean driving record with no accidents or violations will generally result in lower premiums. Insurance companies consider your age and driving experience, as younger and less experienced drivers are statistically more likely to be involved in accidents. Your location plays a role, as premiums are often higher in areas with higher traffic density and accident rates. The type of vehicle you drive also affects your premium, with higher-performance or luxury vehicles typically attracting higher premiums.

Comparing Liability Only Insurance to Full Coverage

Liability-only insurance is generally significantly cheaper than full coverage insurance, as it only covers the other party’s damages and injuries in an accident. Full coverage insurance, on the other hand, includes additional coverage for your own vehicle, such as collision and comprehensive coverage.

While liability-only insurance offers lower premiums, it comes with the risk of significant financial burden if you are at fault in an accident that damages your own vehicle.

For example, if you are involved in an accident that totals your car, you would be responsible for the entire cost of repairs or replacement without collision coverage. Full coverage insurance, while more expensive, provides financial protection against these risks.

Factors Influencing the Cost of Liability Only Insurance

Several factors can influence the cost of liability-only insurance, including:

- Driving History: A clean driving record with no accidents or violations will generally result in lower premiums.

- Age and Experience: Younger and less experienced drivers typically face higher premiums.

- Location: Premiums are often higher in areas with higher traffic density and accident rates.

- Type of Vehicle: Higher-performance or luxury vehicles typically attract higher premiums.

- Credit Score: In some states, insurance companies use credit score as a factor in determining premiums.

Liability Only Insurance and Accidents

Liability-only auto insurance is designed to cover your legal responsibility for damages caused to others in an accident. Understanding the process of filing a claim, your responsibilities, and potential consequences is crucial.

Filing a Claim with Liability Only Insurance

In case of an accident, you need to contact your insurance company immediately to report the incident. You’ll need to provide details of the accident, including the date, time, location, and any injuries or property damage. The insurance company will then investigate the claim and determine your liability.

If you are found at fault, your liability insurance will cover the costs of damages to the other party’s vehicle, medical expenses, and other related costs.

Responsibilities of the Insured in Case of an Accident

Following an accident, you have certain responsibilities as an insured individual. These include:

- Stopping at the scene: You must stop your vehicle and remain at the accident scene until the authorities arrive.

- Exchanging information: You need to exchange your contact information, driver’s license, and insurance details with the other parties involved.

- Reporting the accident: You must report the accident to your insurance company as soon as possible.

- Cooperating with the investigation: You need to cooperate with your insurance company and any authorities investigating the accident.

Financial Consequences of Being Uninsured or Underinsured

Driving without liability insurance or having insufficient coverage can lead to severe financial consequences. If you are found at fault in an accident, you could be held personally responsible for the full cost of damages, including:

- Vehicle repairs: Repairing the other driver’s vehicle could cost thousands of dollars.

- Medical expenses: Covering medical bills for injuries sustained by the other driver can be extremely expensive.

- Lost wages: If the other driver is unable to work due to injuries, you could be responsible for their lost income.

- Legal fees: You might have to pay legal fees if the other driver sues you for damages.

Driving without liability insurance is illegal in most states, and you could face fines, license suspension, or even jail time.

Liability Only Insurance and Legal Considerations

Driving without proper auto insurance can have serious legal and financial consequences. Liability-only insurance may be a cost-effective option for some drivers, but it’s essential to understand the legal requirements and potential risks associated with this type of coverage.

State-Specific Legal Requirements

Each state in the U.S. has its own set of minimum auto insurance requirements. These requirements typically specify the minimum coverage amounts for liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage.

It’s crucial to understand the specific requirements for the state where you reside and where you plan to drive.

Driving without the minimum required insurance coverage can result in serious penalties, including fines, license suspension, and even jail time.

Consequences of Driving Without Insurance

Driving without insurance can lead to several serious consequences:

- Fines and Penalties: Depending on the state, drivers without insurance may face hefty fines and penalties. Some states may even impose additional penalties, such as license suspension or vehicle impoundment.

- Financial Ruin: In the event of an accident, being uninsured can lead to significant financial hardship. You could be held liable for all damages, including medical expenses, property damage, and lost wages.

- Legal Action: If you cause an accident without insurance, the injured party may sue you to recover damages. This can result in a lengthy and expensive legal battle, potentially leading to a large judgment against you.

Legal Risks of Liability Only Insurance

While liability-only insurance can be a cost-effective option for some drivers, it’s important to understand its limitations. This type of coverage only protects you against financial losses caused by your negligence in an accident. It does not provide coverage for your own injuries or vehicle damage.

- Limited Coverage: Liability-only insurance does not cover your own injuries, vehicle damage, or other personal losses. If you are injured in an accident, you will be responsible for all medical expenses and vehicle repair costs.

- Increased Liability: If you are involved in an accident and your coverage is insufficient to cover the other party’s damages, you could be held personally liable for the difference. This could result in significant financial losses and legal action.

- Higher Insurance Premiums: If you are involved in an accident while driving with liability-only insurance, your insurance premiums may increase significantly in the future. This is because insurance companies view drivers with a history of accidents as higher risks.

Alternatives to Liability Only Insurance

Liability-only auto insurance may be a cost-effective choice for some drivers, but it provides limited coverage. If you’re considering this option, it’s crucial to weigh the risks and understand the alternatives available. Here are some common types of auto insurance coverage and their advantages and disadvantages.

Collision Coverage

Collision coverage protects you against damage to your own vehicle in the event of an accident, regardless of fault. It’s essential for drivers with financed or leased vehicles, as lenders often require it.

- Advantages: Provides financial protection for vehicle repairs or replacement after an accident.

- Disadvantages: Higher premiums than liability-only coverage.

Comprehensive Coverage

Comprehensive coverage safeguards you against damage to your vehicle from non-collision incidents, such as theft, vandalism, fire, or natural disasters.

- Advantages: Offers protection against a wide range of risks beyond accidents.

- Disadvantages: Higher premiums than liability-only coverage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or no insurance at all.

- Advantages: Provides financial protection when the other driver is at fault and lacks sufficient coverage.

- Disadvantages: Higher premiums than liability-only coverage.

Personal Injury Protection (PIP)

Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault, after an accident.

- Advantages: Provides financial protection for medical treatment and lost income after an accident.

- Disadvantages: Higher premiums than liability-only coverage.

Rental Reimbursement Coverage

Rental reimbursement coverage helps cover the cost of a rental car if your vehicle is damaged in an accident and is being repaired.

- Advantages: Provides a convenient transportation option while your vehicle is being repaired.

- Disadvantages: Higher premiums than liability-only coverage.

Tips for Choosing the Right Auto Insurance

Choosing the right auto insurance is crucial for protecting yourself financially in the event of an accident. It involves carefully considering various factors and making informed decisions based on your individual needs and circumstances.

Factors to Consider

- Driving History: Your driving record significantly influences your insurance premiums. A clean record with no accidents or violations generally results in lower rates. Conversely, a history of accidents or traffic violations can lead to higher premiums.

- Vehicle Type: The type of vehicle you drive impacts insurance costs. Sports cars, luxury vehicles, and high-performance models often have higher insurance premiums due to their increased risk of accidents and repair costs.

- Location: Your location plays a role in insurance premiums. Areas with higher crime rates or more frequent accidents tend to have higher insurance costs.

- Coverage Needs: Determine the level of coverage you require. If you have a car loan or lease, comprehensive and collision coverage are typically required. Consider your financial situation and the potential risks involved in driving.

- Deductibles: Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but you’ll have to pay more in the event of a claim.

Obtaining Quotes and Comparing Policies

It is essential to obtain quotes from multiple insurance providers to compare rates and coverage options.

- Online Comparison Websites: Several websites allow you to compare quotes from various insurers simultaneously. This provides a convenient way to get a general idea of rates.

- Direct Contact with Insurers: Reach out to insurance companies directly to discuss your specific needs and obtain personalized quotes.

- Insurance Brokers: Brokers can help you navigate the insurance market and find the best policy for your requirements. They can compare quotes from multiple insurers and provide expert advice.

Understanding Insurance Terms and Conditions

Thoroughly reviewing the policy’s terms and conditions is essential to ensure you understand the coverage provided and any limitations.

- Coverage Limits: Understand the maximum amount your insurer will pay for each type of coverage, such as bodily injury liability or property damage liability.

- Exclusions: Pay attention to any specific events or circumstances that are not covered by your policy. For example, certain policies may exclude coverage for accidents involving drunk driving or racing.

- Deductibles: Clearly understand the amount you are responsible for paying before your insurance coverage kicks in.

Liability Only Insurance and the Future

The auto insurance landscape is in constant flux, driven by evolving technology, shifting consumer preferences, and the increasing complexity of modern driving. This evolution will inevitably impact liability-only insurance, shaping its role and relevance in the years to come.

The Impact of Emerging Technologies on Liability Insurance

The advent of autonomous vehicles, connected car technology, and data-driven risk assessment tools will significantly alter the way liability insurance is structured and priced.

- Autonomous Vehicles: The rise of self-driving cars presents both challenges and opportunities for liability insurance. On the one hand, the reduction in human error could lead to fewer accidents and lower premiums. On the other hand, determining liability in autonomous vehicle accidents will be more complex, requiring new frameworks and insurance models. For example, Tesla’s “Full Self-Driving” feature is still considered a Level 2 system, meaning the driver must remain attentive and ready to take control. In such scenarios, liability could be shared between the driver and the vehicle manufacturer, complicating the claims process.

- Connected Car Technology: Telematics devices and connected car systems provide valuable data on driver behavior, driving patterns, and vehicle performance. Insurance companies can leverage this data to create more accurate risk assessments, potentially leading to personalized premiums and discounts for safe drivers. This data can also be used to develop new insurance products tailored to specific driving needs, such as usage-based insurance (UBI) where premiums are calculated based on actual driving habits.

- Data-Driven Risk Assessment: Advanced algorithms and machine learning are increasingly used to analyze vast amounts of data, including driving records, vehicle data, and even social media activity, to predict future driving behavior and risk. This data-driven approach can lead to more precise risk assessments, potentially resulting in lower premiums for low-risk drivers and higher premiums for high-risk drivers.

Real-World Examples and Case Studies

Liability-only auto insurance, while seemingly straightforward, presents practical implications in various real-world scenarios. Examining case studies helps illustrate the benefits and drawbacks of this coverage, offering insights into its practical application.

Illustrative Scenarios

This section explores different situations where liability-only insurance can be advantageous or disadvantageous.

- Scenario 1: A driver with an older vehicle and a low-risk driving history might find liability-only insurance suitable. If they are confident in their driving skills and their vehicle’s value is minimal, they might prioritize cost savings over comprehensive coverage. However, if they were involved in an accident that caused significant damage to another vehicle, they would only be covered for the other party’s damages, not their own vehicle’s repairs.

- Scenario 2: A driver who frequently commutes in high-traffic areas might find liability-only insurance less attractive. The increased risk of accidents and the potential for costly repairs to their own vehicle might outweigh the cost savings. In such situations, comprehensive coverage could offer greater peace of mind.

- Scenario 3: A driver with a limited budget might choose liability-only insurance to minimize their monthly premiums. However, this choice could lead to financial hardship if they were involved in an accident that caused substantial damage to their own vehicle or resulted in injuries.

Case Study: The Impact of Liability-Only Insurance on Accident Costs

A study by the Insurance Institute for Highway Safety (IIHS) analyzed the impact of liability-only insurance on accident costs. The study found that drivers with liability-only insurance were more likely to incur significant out-of-pocket expenses for repairs to their own vehicles after an accident. This is because liability-only insurance only covers the other party’s damages, leaving the policyholder responsible for their own vehicle’s repairs.

Case Study: The Legal Implications of Liability-Only Insurance

A case study involving a driver with liability-only insurance who was involved in an accident that resulted in injuries to the other driver highlights the legal considerations. The driver with liability-only insurance was found liable for the other driver’s injuries and medical expenses, but their own insurance policy did not cover their own medical expenses or lost wages. This situation demonstrates the potential for significant financial hardship if liability-only insurance is chosen without a thorough understanding of its limitations.

Last Recap

Choosing the right auto insurance is a critical decision that can have a significant impact on your financial well-being in the event of an accident. While liability only auto insurance may appeal to some with its lower premiums, it’s crucial to carefully weigh the potential risks and understand the limitations of this coverage. Ultimately, the best approach is to choose a policy that aligns with your individual circumstances, driving habits, and risk tolerance, ensuring adequate protection for yourself and others on the road.