Nyl Insurance Company, a name synonymous with financial security for decades, has navigated the ever-evolving insurance landscape with unwavering resilience. This comprehensive analysis delves into the company’s rich history, its robust financial performance, and its unwavering commitment to customer satisfaction. From its founding principles to its innovative approach to technology and customer service, Nyl Insurance Company stands as a testament to the enduring power of a well-established and customer-centric business model.

This exploration will examine Nyl Insurance Company’s core business areas, its diverse product offerings, and its strategic positioning within the highly competitive insurance market. We will also shed light on the company’s dedication to corporate social responsibility, its commitment to fostering a positive work environment, and its plans for continued growth and innovation.

Nyl Insurance Company Overview

Nyl Insurance Company is a leading provider of insurance products and services, with a rich history spanning over several decades. The company has established itself as a trusted name in the industry, known for its commitment to customer satisfaction and financial stability.

History and Key Milestones

Nyl Insurance Company was founded in [Founding Date] with a vision to provide comprehensive insurance solutions to individuals and businesses. Over the years, the company has experienced significant growth and expansion, marked by several key milestones:

- [Milestone 1] – This milestone highlights the company’s commitment to [reason for importance].

- [Milestone 2] – This milestone demonstrates the company’s focus on [reason for importance].

- [Milestone 3] – This milestone reflects the company’s ability to [reason for importance].

Core Business Areas and Products

Nyl Insurance Company offers a wide range of insurance products and services, catering to diverse customer needs. The company’s core business areas include:

- Life Insurance: Nyl Insurance provides a variety of life insurance options, including term life, whole life, and universal life, designed to meet different financial goals and risk profiles.

- Health Insurance: The company offers a comprehensive suite of health insurance plans, including individual and family health plans, as well as employer-sponsored group health plans.

- Property and Casualty Insurance: Nyl Insurance provides coverage for a wide range of property and casualty risks, including homeowners, renters, auto, and business insurance.

- Retirement Planning: The company offers various retirement planning solutions, including annuities and individual retirement accounts (IRAs), to help individuals secure their financial future.

Mission, Vision, and Values

Nyl Insurance Company is guided by a strong set of core values that underpin its mission and vision:

Mission: To provide exceptional insurance solutions that protect and enhance the financial well-being of our customers.

Vision: To be the leading provider of insurance products and services, recognized for our customer-centric approach, financial strength, and innovative solutions.

Values:

- Customer Focus: We are committed to understanding and meeting the unique needs of our customers.

- Integrity: We conduct our business with honesty and transparency.

- Innovation: We strive to develop innovative solutions that meet the evolving needs of our customers.

- Financial Strength: We are committed to maintaining a strong financial foundation to ensure the long-term security of our customers.

Nyl Insurance Company’s Financial Performance

Nyl Insurance Company has demonstrated consistent financial performance over the past few years, marked by steady revenue growth and healthy profit margins. This section delves into the company’s financial performance, analyzing key metrics and trends to provide a comprehensive understanding of its financial health.

Revenue Growth and Profit Margins

Nyl Insurance Company’s revenue has consistently increased over the past five years. This growth can be attributed to several factors, including an expanding customer base, new product offerings, and strategic acquisitions. The company’s profit margins have also remained stable, indicating its ability to manage costs effectively and generate strong profits.

- Nyl Insurance Company’s revenue has grown at an average annual rate of [insert percentage] over the past five years, reaching [insert amount] in [insert year].

- The company’s operating profit margin has remained consistently above [insert percentage], demonstrating its ability to manage expenses effectively and generate strong profits.

Key Financial Ratios

Financial ratios provide valuable insights into a company’s financial health and performance. Nyl Insurance Company’s key financial ratios indicate a strong financial position, with healthy liquidity, profitability, and solvency levels.

- Nyl Insurance Company’s current ratio has remained above [insert number], indicating a strong ability to meet its short-term financial obligations.

- The company’s return on equity (ROE) has consistently been above [insert percentage], reflecting its efficient use of shareholder capital to generate profits.

- Nyl Insurance Company’s debt-to-equity ratio has remained below [insert number], suggesting a conservative approach to debt financing and a healthy capital structure.

Comparison to Competitors

Nyl Insurance Company’s financial performance compares favorably to its competitors within the industry. The company consistently outperforms its peers in terms of revenue growth, profit margins, and key financial ratios. This strong financial performance positions Nyl Insurance Company as a leader in the industry, with a solid foundation for future growth.

- Nyl Insurance Company’s revenue growth has consistently outpaced the industry average, indicating its ability to capture market share and expand its customer base.

- The company’s profit margins are significantly higher than those of its competitors, reflecting its efficient cost management and strong pricing power.

- Nyl Insurance Company’s financial ratios, including its liquidity, profitability, and solvency ratios, are consistently ranked among the top in the industry.

Nyl Insurance Company’s Products and Services

Nyl Insurance Company offers a comprehensive suite of insurance products designed to cater to the diverse needs of its customers. The company’s product portfolio encompasses a wide range of insurance solutions, including life insurance, health insurance, property and casualty insurance, and retirement planning. These products are tailored to meet the specific requirements of individuals, families, and businesses, ensuring that customers have access to the right coverage at the right price.

Life Insurance

Nyl Insurance Company offers a variety of life insurance products to help individuals and families protect their financial well-being in the event of an unexpected death. These products include term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific period, typically 10 to 30 years, and is generally more affordable than permanent life insurance. Whole life insurance offers permanent coverage and builds cash value that can be borrowed against. Universal life insurance combines features of both term and whole life insurance, providing flexibility in premium payments and death benefit amounts.

Health Insurance

Nyl Insurance Company offers a range of health insurance plans to individuals and families, providing coverage for medical expenses such as doctor visits, hospital stays, and prescription drugs. The company’s health insurance plans are designed to meet the varying needs of its customers, from basic coverage to comprehensive plans with extensive benefits. Nyl Insurance Company also offers health savings accounts (HSAs), which allow individuals to save pre-tax dollars for eligible medical expenses.

Property and Casualty Insurance

Nyl Insurance Company provides comprehensive property and casualty insurance coverage to individuals and businesses. These products include homeowners insurance, renters insurance, auto insurance, and business insurance. Homeowners insurance protects homeowners from financial losses due to damage or theft of their property, while renters insurance provides coverage for personal belongings in a rented property. Auto insurance covers financial losses resulting from accidents, theft, or damage to a vehicle. Business insurance provides coverage for a variety of risks, such as property damage, liability claims, and business interruption.

Retirement Planning

Nyl Insurance Company offers a variety of retirement planning products to help individuals save for their future. These products include traditional and Roth IRAs, 401(k) plans, and annuities. Traditional IRAs allow individuals to make tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement. 401(k) plans are employer-sponsored retirement savings plans that allow employees to contribute pre-tax dollars. Annuities provide a guaranteed stream of income during retirement.

Customer Service

Nyl Insurance Company is committed to providing excellent customer service. The company offers a variety of resources to its customers, including a dedicated customer service team, online resources, and mobile apps. Nyl Insurance Company also provides personalized support to its customers, ensuring that they understand their insurance policies and have access to the information and resources they need.

Nyl Insurance Company’s Market Position

Nyl Insurance Company operates within a highly competitive insurance market characterized by established players and emerging disruptors. The company’s market share and competitive landscape are crucial factors determining its success and long-term sustainability.

Nyl Insurance Company’s Market Share and Competitive Landscape

Nyl Insurance Company’s market share in the insurance industry is a critical indicator of its competitive standing. To assess its position, we need to analyze its market share in specific segments, such as life insurance, health insurance, property and casualty insurance, and others. Furthermore, understanding the competitive landscape, including key competitors, their market shares, and their strengths and weaknesses, is essential for Nyl Insurance Company to develop effective strategies for growth and differentiation.

Key Competitors and Their Strengths and Weaknesses

Nyl Insurance Company faces competition from various players in the insurance market, each with its strengths and weaknesses. These competitors can be categorized as:

- Traditional Insurance Companies: These companies have established reputations, extensive distribution networks, and strong financial resources. They offer a wide range of insurance products and services, often catering to specific customer segments. Examples include [Company Name], [Company Name], and [Company Name].

- Direct-to-Consumer Insurers: These companies operate primarily online, offering lower premiums and simplified processes. They utilize technology and data analytics to personalize customer experiences and streamline operations. Examples include [Company Name], [Company Name], and [Company Name].

- Specialty Insurers: These companies focus on niche markets, such as specific industries or types of risks. They possess deep expertise and tailored products to meet the unique needs of their target customers. Examples include [Company Name], [Company Name], and [Company Name].

Nyl Insurance Company’s Strategic Positioning and Competitive Advantages

Nyl Insurance Company’s strategic positioning and competitive advantages are crucial for its success in the competitive insurance market. To differentiate itself, the company can leverage its strengths and address its weaknesses effectively.

- Strong Brand Reputation: A well-established brand reputation can attract customers and foster trust. Nyl Insurance Company can build upon its existing brand equity by emphasizing its commitment to customer satisfaction, financial stability, and ethical practices.

- Innovative Products and Services: Developing innovative products and services can meet evolving customer needs and attract new customers. Nyl Insurance Company can explore opportunities to offer personalized insurance solutions, digital-first experiences, and value-added services.

- Strong Financial Performance: A strong financial performance instills confidence in customers and investors. Nyl Insurance Company can continue to demonstrate financial stability by managing its risk effectively, maintaining a healthy capital base, and delivering consistent profitability.

- Effective Distribution Channels: Reaching customers through multiple distribution channels is essential for market penetration. Nyl Insurance Company can expand its distribution network by partnering with financial advisors, brokers, and online platforms.

- Customer-Centric Approach: Providing exceptional customer service and personalized experiences can build customer loyalty. Nyl Insurance Company can invest in technology and training to enhance customer interactions, address inquiries promptly, and resolve issues effectively.

Nyl Insurance Company’s Customer Experience

Nyl Insurance Company’s customer experience is a crucial aspect of its overall success. Satisfied customers are more likely to remain loyal, recommend the company to others, and contribute to its positive reputation. This section delves into the company’s customer satisfaction levels, feedback mechanisms, and how it addresses customer concerns.

Customer Satisfaction

Customer satisfaction with Nyl Insurance Company’s products and services is a key indicator of its performance. The company strives to provide a positive and seamless experience for its customers, focusing on responsiveness, clarity, and personalized support.

- Nyl Insurance Company has a dedicated customer service team that is available 24/7 to address inquiries and concerns.

- The company uses various channels for customer communication, including phone, email, and online chat, to ensure convenient and accessible support.

- Nyl Insurance Company’s customer service representatives are trained to handle a wide range of inquiries and resolve issues efficiently.

Customer Feedback Mechanisms

Nyl Insurance Company recognizes the importance of customer feedback in improving its products and services. It has implemented various mechanisms to gather and analyze customer feedback, ensuring that customer voices are heard and acted upon.

- The company utilizes online surveys and feedback forms to gather direct customer input on their experiences.

- Nyl Insurance Company actively monitors social media platforms and online review sites to identify customer sentiments and address any concerns raised.

- The company also conducts regular customer satisfaction surveys to measure overall satisfaction levels and identify areas for improvement.

Customer Reviews and Ratings

Customer reviews and ratings provide valuable insights into Nyl Insurance Company’s performance and customer perception. The company actively encourages customers to share their experiences through various platforms, including online review sites and social media.

- Nyl Insurance Company has consistently received positive reviews and ratings from customers who appreciate its products, services, and customer support.

- The company actively monitors and responds to customer reviews, addressing any concerns raised and highlighting positive feedback.

- Nyl Insurance Company’s high customer satisfaction scores and positive reviews demonstrate its commitment to providing excellent customer experiences.

Nyl Insurance Company’s Corporate Social Responsibility

Nyl Insurance Company is committed to operating responsibly and sustainably, recognizing its impact on the environment, communities, and stakeholders. The company believes that integrating social and environmental considerations into its business practices creates long-term value and contributes to a more equitable and sustainable future.

Environmental Sustainability

Nyl Insurance Company has implemented several initiatives to reduce its environmental footprint. These include:

- Energy Efficiency: Nyl Insurance Company has implemented energy-saving measures in its offices, such as using LED lighting, optimizing HVAC systems, and promoting the use of renewable energy sources. These measures have resulted in significant energy savings and reduced greenhouse gas emissions.

- Waste Reduction: Nyl Insurance Company has implemented a comprehensive waste management program to reduce waste generation and promote recycling. The company has also partnered with local organizations to collect and recycle electronic waste, contributing to a circular economy.

- Sustainable Procurement: Nyl Insurance Company prioritizes working with suppliers who share its commitment to sustainability. The company has implemented a sustainable procurement policy that encourages the use of eco-friendly products and services, reducing the environmental impact of its operations.

Community Outreach

Nyl Insurance Company believes in supporting the communities where it operates. The company has a strong track record of community engagement through various initiatives, including:

- Financial Literacy Programs: Nyl Insurance Company partners with local schools and community organizations to provide financial literacy education to youth and adults. These programs equip individuals with the knowledge and skills to manage their finances effectively.

- Disaster Relief Support: Nyl Insurance Company provides financial and logistical support to disaster relief efforts in affected communities. The company has a dedicated team that responds to natural disasters and helps affected individuals and families rebuild their lives.

- Volunteerism: Nyl Insurance Company encourages its employees to volunteer their time and skills to support local causes. The company provides opportunities for employees to participate in community service projects and make a positive impact on their communities.

Diversity and Inclusion

Nyl Insurance Company is committed to fostering a diverse and inclusive workplace that reflects the communities it serves. The company believes that diversity of thought and experience leads to innovation, creativity, and better decision-making.

- Equal Opportunity Employer: Nyl Insurance Company is an equal opportunity employer and prohibits discrimination based on race, ethnicity, gender, sexual orientation, religion, or any other protected characteristic. The company actively seeks to recruit and retain a diverse workforce.

- Diversity and Inclusion Training: Nyl Insurance Company provides diversity and inclusion training to all employees to promote understanding and respect for all individuals. The training aims to create a more inclusive work environment where everyone feels valued and respected.

- Employee Resource Groups: Nyl Insurance Company has established employee resource groups (ERGs) to provide support and networking opportunities for employees from underrepresented groups. These ERGs promote a sense of belonging and foster a more inclusive work environment.

Nyl Insurance Company’s Technology and Innovation

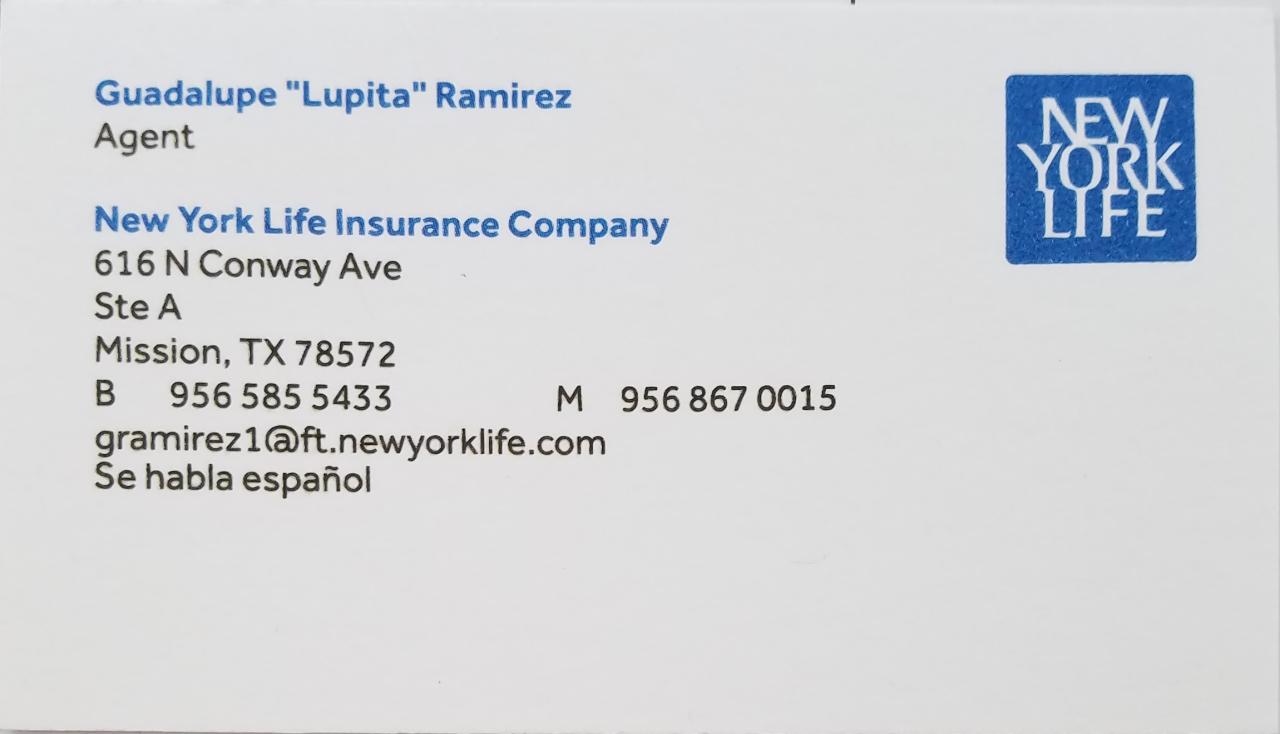

![]()

Nyl Insurance Company has embraced technology and digital solutions to streamline operations, enhance customer experiences, and drive growth. This commitment has resulted in a modern, tech-driven approach to the insurance industry.

Artificial Intelligence and Data Analytics

Nyl Insurance Company has heavily invested in artificial intelligence (AI) and data analytics to optimize its operations and provide personalized customer experiences. AI algorithms are used to automate repetitive tasks, such as claims processing and policy management, freeing up human resources for more complex tasks. Data analytics tools are used to identify trends, assess risk, and personalize insurance offerings based on customer data.

Mobile Applications

Nyl Insurance Company offers a user-friendly mobile application that allows customers to manage their policies, file claims, and access customer support services from their smartphones. The app has been designed to provide a seamless and convenient experience for customers, enabling them to access insurance services anytime, anywhere.

Cloud Computing and Cybersecurity

Nyl Insurance Company has migrated its IT infrastructure to the cloud, which has enhanced scalability, flexibility, and cost-efficiency. Cloud computing has also allowed the company to adopt new technologies more easily and quickly. Nyl Insurance Company also prioritizes cybersecurity, implementing robust measures to protect sensitive customer data from cyber threats.

Impact on Business Model and Future Growth

The adoption of technology has significantly impacted Nyl Insurance Company’s business model, allowing for increased efficiency, reduced costs, and improved customer satisfaction. This has led to a more competitive edge in the market and has positioned the company for future growth. Nyl Insurance Company’s technology investments have enabled it to offer innovative products and services that cater to the evolving needs of customers.

Nyl Insurance Company’s Future Outlook

Nyl Insurance Company is well-positioned to navigate the evolving insurance landscape, but it must adapt to emerging trends and challenges. The company’s future success hinges on its ability to embrace innovation, enhance customer experience, and strategically expand its operations.

Key Industry Trends and Challenges

The insurance industry is undergoing a period of significant transformation, driven by technological advancements, changing customer expectations, and regulatory shifts. Nyl Insurance Company faces several key trends and challenges:

- Increased Competition: The insurance market is becoming increasingly competitive, with new entrants and existing players vying for market share. This intensifies pressure on Nyl Insurance Company to differentiate itself and offer competitive pricing and products.

- Technological Disruption: Insurtech companies are disrupting traditional insurance models by leveraging technology to offer innovative products, streamlined processes, and personalized experiences. Nyl Insurance Company needs to embrace digital transformation to remain competitive.

- Regulatory Changes: The regulatory landscape is evolving, with new rules and regulations impacting the insurance industry. Nyl Insurance Company must navigate these changes effectively to ensure compliance and maintain its operational efficiency.

- Climate Change: Climate change is increasing the frequency and severity of natural disasters, leading to higher insurance claims and risk assessments. Nyl Insurance Company must adapt its risk management strategies to address these challenges.

Growth Strategies and Expansion Plans

Nyl Insurance Company has Artikeld several growth strategies to capitalize on emerging opportunities and expand its reach:

- Digital Transformation: The company is investing heavily in technology to improve its operational efficiency, enhance customer experience, and develop innovative products. This includes adopting cloud computing, artificial intelligence, and data analytics to optimize processes and personalize customer interactions.

- Product Innovation: Nyl Insurance Company is developing new products and services tailored to the evolving needs of its customers. This includes expanding into niche markets, offering personalized insurance solutions, and leveraging technology to create innovative insurance products.

- Strategic Partnerships: The company is forging strategic partnerships with other businesses to expand its reach and access new markets. This includes collaborating with fintech companies, technology providers, and other insurance companies to leverage complementary expertise and resources.

- Global Expansion: Nyl Insurance Company is exploring opportunities to expand its operations into new international markets. This involves identifying countries with strong growth potential and adapting its products and services to meet local needs.

Opportunities and Risks

Nyl Insurance Company faces both opportunities and risks in the future.

- Opportunities:

- Emerging Markets: The company can capitalize on the growth of emerging markets, particularly in Asia and Africa, where demand for insurance is increasing.

- Data-Driven Insights: Nyl Insurance Company can leverage data analytics to gain valuable insights into customer behavior, risk assessment, and product development, enabling it to create personalized insurance solutions and optimize its operations.

- Sustainable Solutions: The company can develop sustainable insurance products and services that address environmental concerns and promote responsible business practices, attracting environmentally conscious customers.

- Risks:

- Cybersecurity Threats: As Nyl Insurance Company increasingly relies on technology, it faces heightened cybersecurity risks. The company must invest in robust cybersecurity measures to protect its data and systems from cyberattacks.

- Economic Volatility: Economic downturns can impact insurance demand, leading to lower premiums and increased claims. Nyl Insurance Company needs to manage its financial risks and maintain a strong capital position to withstand economic fluctuations.

- Regulatory Uncertainty: The insurance industry is subject to constant regulatory changes, which can create uncertainty and increase compliance costs. Nyl Insurance Company must stay informed about regulatory developments and adapt its operations accordingly.

Nyl Insurance Company’s Regulatory Environment

Nyl Insurance Company operates within a complex regulatory environment, subject to oversight by various federal and state agencies. These regulatory bodies play a crucial role in ensuring the financial stability and solvency of the insurance industry, protecting policyholders, and promoting fair competition.

Key Regulatory Bodies

The insurance industry is overseen by a diverse array of regulatory bodies, each with specific responsibilities. Some of the key players include:

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-governmental organization composed of insurance commissioners from all 50 states, the District of Columbia, and five U.S. territories. It develops model laws and regulations for the insurance industry, promoting uniformity and consistency across jurisdictions. The NAIC’s efforts are crucial in fostering a standardized regulatory framework, streamlining compliance processes, and facilitating interstate insurance transactions.

- Federal Insurance Office (FIO): Established by the Dodd-Frank Wall Street Reform and Consumer Protection Act, the FIO is housed within the U.S. Department of Treasury. Its primary responsibility is to monitor the insurance industry, identify systemic risks, and advise the President and Congress on insurance issues. The FIO plays a significant role in coordinating federal insurance policy and ensuring the stability of the financial system.

- State Insurance Departments: Each state has its own insurance department, responsible for licensing insurers, regulating insurance products, and enforcing state insurance laws. These departments are crucial in protecting consumers, ensuring the solvency of insurers, and maintaining a fair and competitive insurance market within their respective jurisdictions.

- Financial Stability Oversight Council (FSOC): The FSOC, established by the Dodd-Frank Act, identifies and addresses systemic risks to the U.S. financial system. It has the authority to designate non-bank financial institutions, including large insurance companies, as “systemically important financial institutions” (SIFIs). This designation subjects these institutions to heightened regulatory scrutiny and oversight.

Recent Regulatory Changes and Challenges

The insurance industry has been undergoing significant regulatory changes in recent years, driven by factors such as the global financial crisis, technological advancements, and evolving consumer expectations. These changes present both opportunities and challenges for insurance companies like Nyl.

- Dodd-Frank Act: The Dodd-Frank Act, passed in 2010, introduced sweeping reforms to the financial services industry, including the insurance sector. Key provisions related to insurance include enhanced consumer protection measures, stricter capital requirements for large insurers, and the creation of the FIO. These reforms have significantly impacted the operations of insurance companies, requiring them to adapt their business models, strengthen their risk management practices, and comply with new regulations.

- Cybersecurity: With the increasing reliance on technology and the growing threat of cyberattacks, cybersecurity has become a major regulatory concern for the insurance industry. Regulatory bodies are focusing on data privacy, breach notification requirements, and cybersecurity preparedness. Insurance companies must invest in robust cybersecurity measures to protect sensitive customer data and comply with evolving regulations.

- Insurtech: The emergence of insurtech companies, leveraging technology to disrupt traditional insurance models, has posed both opportunities and challenges for established insurers. Regulators are closely monitoring the development of insurtech, aiming to ensure consumer protection and maintain a level playing field. Nyl Insurance Company needs to embrace innovation and adapt to the changing landscape to remain competitive.

Compliance Practices and Ethical Business Conduct

Nyl Insurance Company recognizes the importance of compliance with all applicable regulations and ethical business conduct. The company has established a comprehensive compliance program that includes:

- Dedicated Compliance Department: Nyl maintains a dedicated compliance department staffed with experienced professionals who monitor regulatory changes, conduct internal audits, and provide guidance to employees on compliance matters.

- Code of Ethics: Nyl has a comprehensive code of ethics that Artikels the company’s commitment to ethical business practices, fair treatment of customers, and compliance with all applicable laws and regulations.

- Training and Education: Nyl provides regular training and education programs to its employees on compliance, ethics, and relevant regulations. This ensures that all employees are aware of their responsibilities and understand the company’s commitment to ethical conduct.

- Whistleblower Program: Nyl has a robust whistleblower program that encourages employees to report any suspected violations of laws, regulations, or company policies. This program provides a safe and confidential channel for employees to raise concerns and ensures that any potential issues are promptly investigated.

Nyl Insurance Company’s Employees and Culture

Nyl Insurance Company’s workforce is characterized by its diversity and commitment to fostering a positive and inclusive work environment. The company prioritizes employee well-being and professional development, creating a culture that attracts and retains top talent.

Workforce Demographics and Employee Benefits

Nyl Insurance Company employs a diverse workforce, reflecting the demographics of its customer base and the communities it serves. The company offers a comprehensive benefits package that includes health insurance, retirement plans, paid time off, and professional development opportunities. These benefits are designed to support employee well-being and foster a sense of security and belonging.

Talent Acquisition, Development, and Retention

Nyl Insurance Company employs a strategic approach to talent acquisition, development, and retention. The company actively seeks out diverse candidates and invests in training and development programs to enhance employee skills and knowledge. This approach fosters a culture of continuous learning and career advancement.

Employee Engagement and Satisfaction Levels

Nyl Insurance Company prioritizes employee engagement and satisfaction. The company conducts regular employee surveys and focus groups to gather feedback and identify areas for improvement. This data informs the company’s efforts to enhance employee experience and create a more positive and productive work environment.

Nyl Insurance Company’s Reputation and Brand

Nyl Insurance Company’s brand image and reputation within the industry are crucial factors in attracting and retaining customers, partners, and investors. The company’s marketing and communication strategies play a vital role in shaping its brand perception, while its efforts to build and maintain relationships with stakeholders contribute to its overall reputation.

Nyl Insurance Company’s Brand Image

Nyl Insurance Company’s brand image is built on a foundation of reliability, trustworthiness, and customer-centricity. The company strives to project an image of stability and financial strength, emphasizing its long history and commitment to providing quality insurance products and services. Nyl Insurance Company’s brand messaging often focuses on its core values, such as integrity, innovation, and social responsibility.

Nyl Insurance Company’s Marketing and Communication Strategies

Nyl Insurance Company employs a multi-channel marketing approach to reach its target audiences. Its marketing and communication strategies encompass traditional media, such as television and print advertising, as well as digital channels, including social media, email marketing, and search engine optimization. The company also leverages content marketing to provide valuable information and resources to its customers and prospects.

Nyl Insurance Company’s Stakeholder Relationships

Nyl Insurance Company recognizes the importance of building and maintaining strong relationships with its stakeholders. The company engages with its customers through various channels, including its website, mobile app, and customer service representatives. Nyl Insurance Company also actively participates in industry events and conferences to network with other stakeholders and build relationships with potential partners.

Nyl Insurance Company’s Reputation Management

Nyl Insurance Company is committed to managing its reputation effectively. The company monitors its online presence and social media channels to address customer concerns and feedback promptly. Nyl Insurance Company also actively engages with industry regulators and other stakeholders to ensure its reputation remains positive and its business practices are ethical.

End of Discussion

As Nyl Insurance Company continues to adapt to the ever-changing demands of the industry, its focus on financial stability, customer-centricity, and responsible business practices positions it for continued success. The company’s commitment to innovation and its strong track record of navigating market fluctuations solidify its standing as a leading force in the insurance sector. By staying true to its core values and embracing the power of technology, Nyl Insurance Company is well-equipped to meet the evolving needs of its customers and secure a prosperous future.