State Farm, a household name in the insurance industry, is a major player in the car insurance market. Known for its extensive network, customer-centric approach, and competitive rates, State Farm offers a wide range of coverage options to suit various driver profiles and vehicle types. Understanding how State Farm determines its car insurance rates is crucial for drivers seeking the best value and protection for their needs.

This comprehensive guide delves into the intricacies of State Farm car insurance rates, exploring the key factors that influence pricing, comparing rates to competitors, and uncovering the discounts and savings opportunities available. We’ll also examine the customer experience, policy options, claims process, and how State Farm caters to different driver segments and vehicle types.

State Farm Car Insurance Overview

State Farm is a leading provider of car insurance in the United States, boasting a long history and a strong reputation for reliability and customer service. Founded in 1922, the company has grown to become one of the largest and most trusted insurers in the country, with a wide network of agents and a comprehensive suite of insurance products.

State Farm’s Car Insurance Services and Products

State Farm offers a range of car insurance products designed to meet the diverse needs of its customers. These products include:

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. It covers the costs of medical bills, property damage, and legal fees up to the policy limits.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. It covers the cost of repairs or replacement up to the actual cash value of the vehicle, minus any deductible.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, and natural disasters. It covers the cost of repairs or replacement up to the actual cash value of the vehicle, minus any deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers the costs of medical bills, property damage, and legal fees up to the policy limits.

- Personal Injury Protection (PIP): This coverage, also known as no-fault coverage, covers your own medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. It is typically required in states with no-fault insurance laws.

State Farm Car Insurance Features

State Farm’s car insurance policies offer several key features that make them attractive to customers. These features include:

- Coverage Options: State Farm offers a wide range of coverage options to meet the specific needs of its customers. This allows you to customize your policy to ensure you have the right level of protection for your situation.

- Discounts: State Farm offers a variety of discounts that can help you save money on your car insurance premiums. These discounts include safe driving discounts, multi-policy discounts, good student discounts, and more.

- Customer Service: State Farm is known for its excellent customer service. You can access customer service through a variety of channels, including phone, email, and online chat. State Farm also has a network of agents who can provide personalized assistance and support.

- Online Tools: State Farm offers a range of online tools that make it easy to manage your car insurance policy. These tools include online payment options, policy management features, and claims reporting capabilities.

Factors Influencing State Farm Car Insurance Rates

State Farm, like most insurance companies, considers various factors to determine your car insurance premium. These factors are designed to assess your individual risk profile, ensuring that you pay a fair price for the coverage you need.

Driving History

Your driving history is a key factor in determining your car insurance rates. This includes your past driving record, including accidents, traffic violations, and driving convictions. A clean driving record typically results in lower premiums, while a history of accidents or violations can lead to higher rates. For example, a driver with multiple speeding tickets or a DUI conviction will likely face higher premiums compared to a driver with no violations.

Vehicle Type

The type of vehicle you drive also significantly impacts your insurance rates. State Farm considers factors such as the vehicle’s make, model, year, safety features, and value. For instance, luxury cars or high-performance vehicles often have higher insurance premiums due to their higher repair costs and greater risk of theft. Conversely, older, less expensive vehicles may have lower premiums.

Location

The location where you live plays a crucial role in your car insurance rates. State Farm considers factors such as the population density, crime rate, and frequency of accidents in your area. For example, urban areas with heavy traffic and higher crime rates generally have higher insurance premiums compared to rural areas.

Other Factors

Beyond the primary factors discussed above, State Farm also considers other factors, including:

- Age and Gender: Younger drivers and male drivers often face higher premiums due to their higher risk of accidents.

- Credit Score: Your credit score can influence your car insurance rates, as it reflects your financial responsibility. Drivers with good credit scores may qualify for lower premiums.

- Coverage Options: The type and amount of coverage you choose, such as liability, collision, and comprehensive, directly impact your premium.

- Driving Habits: Your driving habits, such as mileage and driving patterns, can influence your rates. For example, drivers who commute long distances or frequently drive at night may face higher premiums.

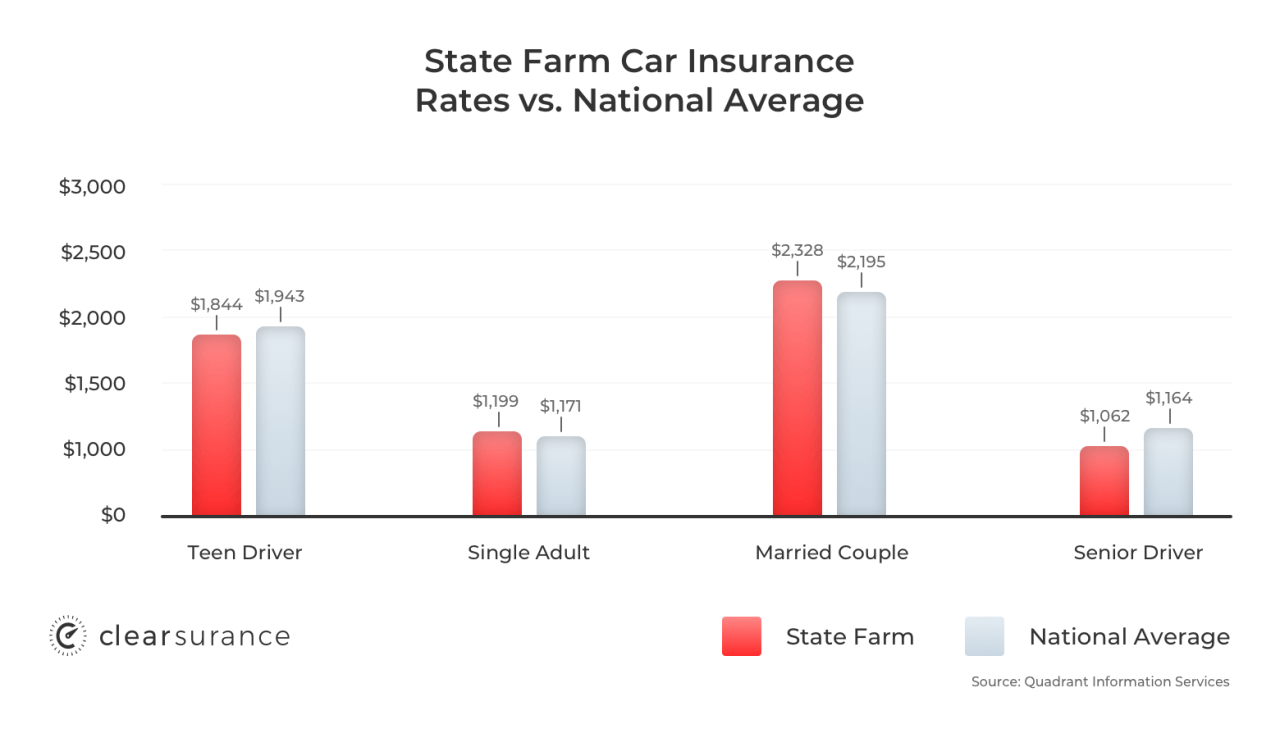

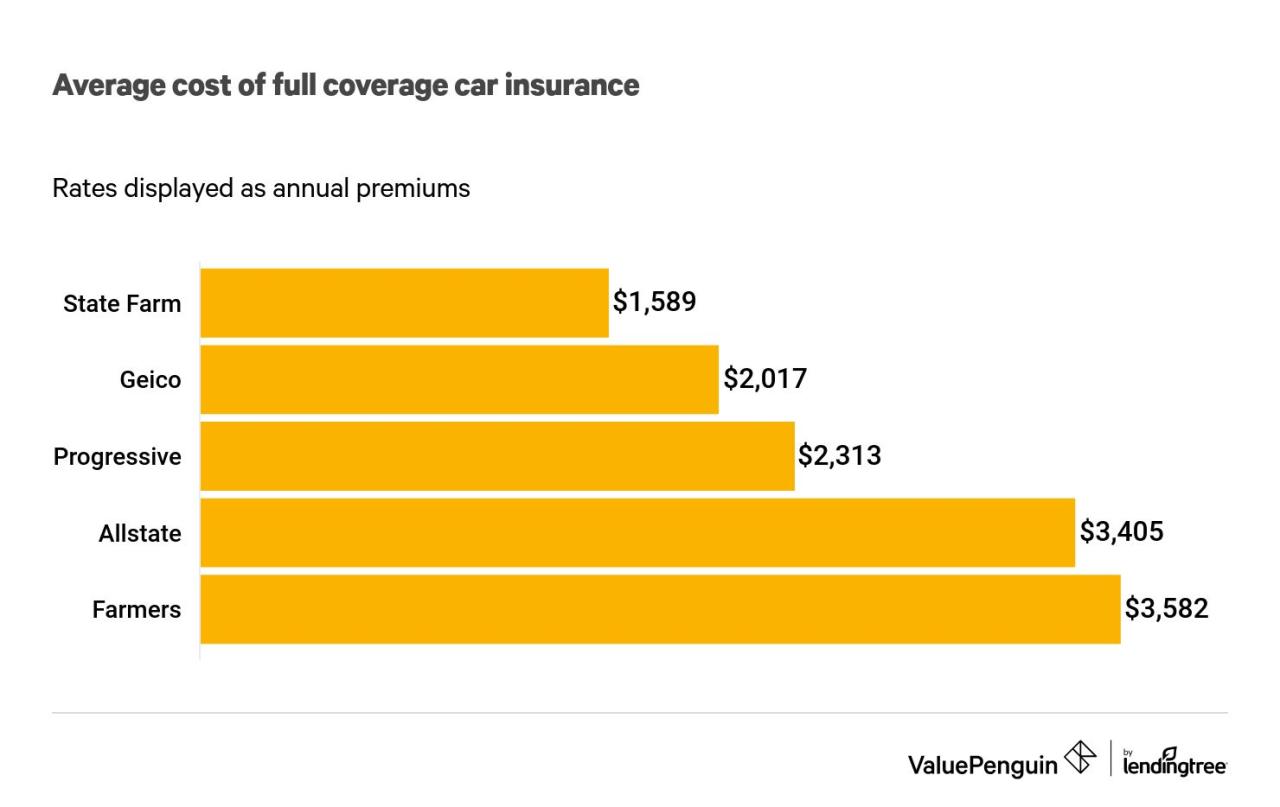

State Farm Car Insurance Rates Compared to Competitors

Determining the best car insurance provider involves comparing rates and features across different companies. State Farm is a prominent player in the market, but its rates may not always be the most competitive. This section will compare State Farm’s car insurance rates with those of other major insurance providers to help you make an informed decision.

Comparison of Car Insurance Rates

To understand how State Farm’s rates stack up, it’s essential to compare them with other leading providers. The following table presents an overview of average car insurance rates, key features, and customer satisfaction ratings for several major insurance companies:

| Provider | Average Rate | Key Features | Customer Satisfaction Rating |

|---|---|---|---|

| State Farm | $1,400 per year | Wide range of coverage options, strong financial stability, extensive agent network | 82/100 (J.D. Power) |

| Geico | $1,300 per year | Competitive rates, strong online presence, easy claims process | 84/100 (J.D. Power) |

| Progressive | $1,450 per year | Name Your Price tool, personalized discounts, strong customer service | 80/100 (J.D. Power) |

| Allstate | $1,500 per year | Drive Safe & Save program, mobile app with telematics features, comprehensive coverage options | 79/100 (J.D. Power) |

| USAA | $1,250 per year | Exclusive for military members and their families, excellent customer service, competitive rates | 91/100 (J.D. Power) |

It’s important to note that these average rates are estimates and can vary significantly based on individual factors such as driving history, location, vehicle type, and coverage level.

Advantages and Disadvantages of Choosing State Farm

Choosing State Farm as your car insurance provider comes with certain advantages and disadvantages.

Advantages

- Extensive Agent Network: State Farm has a vast network of agents across the country, providing convenient access to personalized advice and assistance.

- Strong Financial Stability: State Farm is a financially sound company with a long history, offering peace of mind regarding claim payouts.

- Wide Range of Coverage Options: State Farm offers a comprehensive range of coverage options to suit different needs, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Disadvantages

- Potentially Higher Rates: While State Farm offers competitive rates in some areas, its rates may be higher than those of other providers in certain locations or for specific driver profiles.

- Limited Online Options: State Farm’s online platform for managing policies and filing claims is not as robust as some competitors, potentially requiring more phone calls or in-person visits.

State Farm Car Insurance Discounts and Savings

State Farm offers a wide range of discounts that can significantly reduce your car insurance premiums. By taking advantage of these discounts, you can save a substantial amount of money on your insurance costs.

Discount Eligibility and Examples

State Farm’s discounts are designed to reward safe driving practices, responsible vehicle ownership, and loyalty. To be eligible for a particular discount, you must meet specific criteria. For example, the Good Driver Discount requires a clean driving record, while the Safe Driver Discount is based on your driving history and the absence of accidents or violations.

Here are some of the most common discounts offered by State Farm:

- Good Driver Discount: This discount is available to drivers with a clean driving record. The amount of the discount varies depending on your driving history and the specific discount offered in your state.

- Safe Driver Discount: This discount is available to drivers who have not been involved in an accident or received a traffic violation for a certain period. The amount of the discount may vary depending on the specific discount offered in your state.

- Defensive Driving Course Discount: Taking a defensive driving course can help you improve your driving skills and reduce your risk of accidents. State Farm offers a discount for completing an approved defensive driving course.

- Multi-Policy Discount: If you bundle your car insurance with other types of insurance, such as homeowners or renters insurance, you can qualify for a multi-policy discount. This discount can be substantial, as it incentivizes you to insure multiple assets with State Farm.

- Anti-theft Device Discount: Installing anti-theft devices in your car can help deter theft and reduce the risk of your car being stolen. State Farm offers a discount for vehicles equipped with approved anti-theft devices.

- Vehicle Safety Features Discount: Modern cars are often equipped with safety features that can help prevent accidents. State Farm offers discounts for vehicles with features such as anti-lock brakes, airbags, and electronic stability control.

- Loyalty Discount: State Farm rewards loyal customers with discounts for maintaining a continuous policy with them. The amount of the discount may vary depending on the length of your policy.

- Paperless Discount: Choosing to receive your insurance documents electronically instead of through the mail can save State Farm on printing and postage costs. They often pass this savings onto customers in the form of a discount.

Maximizing Discounts and Savings

- Maintain a Clean Driving Record: This is the most important factor in qualifying for many of State Farm’s discounts. Avoid traffic violations, accidents, and reckless driving behaviors to maintain a good driving record.

- Bundle Your Insurance Policies: Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can significantly reduce your premiums.

- Install Anti-theft Devices: Installing an anti-theft device in your car can make it less attractive to thieves and qualify you for a discount.

- Consider Safety Features: When purchasing a new car, consider models equipped with advanced safety features. These features can reduce your risk of accidents and qualify you for a discount.

- Take a Defensive Driving Course: Completing an approved defensive driving course can help you improve your driving skills and reduce your risk of accidents, leading to a discount on your insurance premiums.

- Review Your Policy Regularly: Periodically review your policy to ensure you are taking advantage of all available discounts and that your coverage is still appropriate for your needs.

- Ask About Discounts: Don’t hesitate to ask your State Farm agent about available discounts. They may be aware of discounts you are eligible for that you are not aware of.

State Farm Car Insurance Customer Experience

State Farm, a leading insurance provider in the United States, boasts a vast customer base and a reputation for providing a comprehensive range of insurance products. The company is known for its extensive network of agents, commitment to customer service, and innovative digital tools. This section delves into the intricacies of the State Farm car insurance customer experience, exploring the application process, claims handling, and customer service, while also examining customer reviews and testimonials, both positive and negative. Furthermore, the availability of online tools, mobile apps, and other resources for managing car insurance policies will be discussed.

Application Process

The application process for State Farm car insurance is generally straightforward and can be completed online, over the phone, or through a local agent. The online application process is user-friendly, guiding applicants through a series of questions to gather necessary information. The application typically requires details about the vehicle, driving history, and personal information. Once the application is submitted, State Farm will provide a quote within a short timeframe. For those who prefer a more personalized experience, State Farm agents are available to assist with the application process and answer any questions.

Claims Handling

State Farm has a reputation for handling claims efficiently and effectively. The company offers various channels for filing claims, including online, phone, and through local agents. State Farm provides 24/7 access to its claims handling system, allowing customers to file claims anytime. Once a claim is filed, State Farm assigns a claims adjuster who will investigate the incident and determine the extent of the damage. The company strives to resolve claims promptly and fairly, aiming to minimize the stress associated with accidents.

Customer Service

State Farm prides itself on its exceptional customer service. The company offers multiple avenues for customer support, including phone, email, and online chat. State Farm’s customer service representatives are known for their knowledge, responsiveness, and willingness to go the extra mile to address customer concerns. Customers can access their insurance policies, make payments, and manage their accounts online through State Farm’s user-friendly website. The company also provides mobile apps for iOS and Android devices, allowing customers to access their insurance information, file claims, and manage their policies on the go.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the customer experience with State Farm car insurance. While State Farm generally receives positive feedback for its customer service, claims handling, and online tools, there are instances where customers have expressed dissatisfaction. Some common criticisms include long wait times for customer service, difficulties in resolving complex claims, and limited flexibility in policy options. It is important to note that customer experiences can vary widely depending on individual circumstances and the specific agent or claims adjuster involved.

Online Tools and Mobile Apps

State Farm offers a comprehensive suite of online tools and mobile apps designed to enhance the customer experience. The company’s website allows customers to manage their policies, make payments, file claims, and access various resources, such as policy documents and FAQs. The State Farm mobile app provides similar functionality, allowing customers to access their insurance information, file claims, and manage their policies on the go. The app also features a “Drive Safe & Save” program, which rewards safe driving habits with discounts.

State Farm Car Insurance Policy Options

State Farm offers a range of car insurance policy options to cater to different needs and risk tolerances. Understanding the various coverage types and their benefits can help you choose the right policy to protect yourself and your vehicle financially.

Liability Coverage

Liability coverage is a mandatory insurance requirement in most states. It protects you financially if you cause an accident that results in injuries or property damage to others. This coverage typically includes:

- Bodily injury liability: Covers medical expenses, lost wages, and pain and suffering for injuries caused to others in an accident.

- Property damage liability: Covers damage to other people’s vehicles or property in an accident.

For example, if you are at fault in an accident that causes $10,000 in damages to another driver’s car, your liability coverage will pay for the repairs.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is essential if you want to protect your vehicle from the financial impact of an accident. For example, if you collide with another car, collision coverage will pay for the repairs to your vehicle, even if you were at fault.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. This coverage is optional, but it can be helpful if you want to protect your vehicle from the financial impact of these types of events. For example, if your car is stolen, comprehensive coverage will pay for its replacement or repair.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance. This coverage pays for your medical expenses, lost wages, and pain and suffering if you are injured in an accident caused by an uninsured or underinsured driver. For example, if you are hit by a driver who does not have insurance, UM/UIM coverage will pay for your medical expenses and other damages.

Choosing the Right Policy

When choosing a car insurance policy, consider the following factors:

- Your driving history: Drivers with a clean driving record typically pay lower premiums than drivers with a history of accidents or traffic violations.

- Your vehicle’s value: The value of your vehicle will affect the cost of collision and comprehensive coverage. More expensive vehicles will have higher premiums.

- Your location: Insurance premiums vary by location due to factors such as the frequency of accidents and the cost of living.

- Your risk tolerance: If you are comfortable taking on more risk, you may choose a policy with lower coverage limits, which will typically result in lower premiums.

It is crucial to discuss your specific needs and risk tolerance with a State Farm agent to determine the best car insurance policy for you.

State Farm Car Insurance Claims Process

Filing a car insurance claim with State Farm is a straightforward process, but it’s essential to understand the steps involved to ensure a smooth and successful outcome. This section Artikels the claims process, documentation requirements, timelines, dispute resolution options, and tips for maximizing claim success.

Reporting the Accident

The first step in filing a claim is to report the accident to State Farm as soon as possible. You can do this by calling their 24/7 claims hotline or using their online claims portal. State Farm recommends reporting the accident within 24 hours to avoid any potential delays in processing your claim.

When reporting the accident, be prepared to provide the following information:

- Your policy number

- The date, time, and location of the accident

- A description of the accident, including the parties involved and any injuries

- The names and contact information of any witnesses

- The make, model, and year of all vehicles involved

- The license plate numbers of all vehicles involved

- Any photos or videos you took at the scene

State Farm will then assign a claims adjuster to your case, who will be responsible for investigating the accident and determining your coverage.

Documentation Required

To support your claim, you will need to provide State Farm with the following documentation:

- A copy of your driver’s license

- A copy of your vehicle registration

- A copy of your insurance policy

- A police report (if applicable)

- Photos and videos of the damage to your vehicle

- Estimates from repair shops for the cost of repairs

- Medical bills and records (if applicable)

- Proof of lost wages (if applicable)

Providing all required documentation promptly will help expedite the claims process.

Claims Processing Timeline

The timeline for processing a car insurance claim with State Farm can vary depending on the complexity of the claim and the availability of all required documentation. However, State Farm aims to process most claims within 30 days.

State Farm will typically send you a written claim status update every 10 days, informing you of the progress of your claim.

Dispute Resolution

If you disagree with State Farm’s decision on your claim, you have the right to appeal the decision. You can do this by contacting your claims adjuster or filing a formal appeal with State Farm.

State Farm will then review your claim and provide you with a written decision. If you are still not satisfied with the decision, you may have the option to pursue arbitration or litigation.

Tips for Maximizing Claim Success

To maximize your chances of a successful claim, follow these tips:

- Report the accident to State Farm as soon as possible.

- Provide all required documentation promptly.

- Be honest and accurate in your reporting of the accident.

- Keep detailed records of all communications with State Farm.

- Get a second opinion from another repair shop if you are not satisfied with the first estimate.

- Be prepared to negotiate with State Farm.

State Farm Car Insurance for Different Drivers

State Farm, being one of the largest car insurance providers in the U.S., caters to a diverse range of drivers with tailored policies and pricing structures. This ensures that drivers of all ages, experience levels, and driving records find suitable coverage options.

Young Drivers

Young drivers, typically those under the age of 25, are often considered high-risk by insurance companies due to their lack of experience and higher propensity for accidents. State Farm, like other insurers, acknowledges this risk and offers a variety of options for young drivers, including:

* Discounts for good grades: State Farm rewards young drivers who maintain good academic performance with discounts on their car insurance premiums. This encourages responsible behavior and academic achievement.

* Defensive driving courses: Completing a defensive driving course can lead to discounts for young drivers. These courses emphasize safe driving practices and can help reduce the risk of accidents.

* Limited mileage discounts: Young drivers who drive less frequently can benefit from discounts based on their limited mileage. This recognizes that drivers with lower mileage tend to be involved in fewer accidents.

Seniors

Senior drivers, often defined as those over 65, may face higher insurance premiums due to factors such as age-related health conditions and potential decline in reaction time. However, State Farm offers several programs to address the specific needs of senior drivers:

* Defensive driving courses: Similar to young drivers, senior drivers can earn discounts by completing defensive driving courses, which emphasize safe driving practices tailored for older drivers.

* Mature driver discounts: State Farm offers discounts for senior drivers who demonstrate safe driving habits and have a clean driving record. This recognizes the experience and responsible driving behavior of many senior drivers.

* Specialized coverage options: State Farm provides tailored coverage options for senior drivers, such as specialized medical payments coverage for potential health complications arising from accidents.

Drivers with Poor Driving Records

Drivers with a history of accidents, traffic violations, or DUIs are generally considered high-risk by insurance companies. State Farm addresses this by:

* Higher premiums: Drivers with poor driving records will typically face higher insurance premiums to reflect the increased risk they pose.

* Limited coverage options: In some cases, drivers with severe driving violations may have limited access to certain coverage options, such as full coverage.

* Driving improvement programs: State Farm may offer driving improvement programs to help drivers with poor driving records improve their skills and reduce their risk of future accidents. These programs can lead to potential premium reductions in the future.

State Farm Car Insurance for Different Vehicles

State Farm offers a comprehensive range of car insurance options tailored to different vehicle types, ensuring adequate coverage for various driving needs. Understanding how car insurance rates vary based on vehicle type is crucial for finding the best policy that fits your individual requirements.

Car Insurance Rates for Different Vehicle Types

The type of vehicle you drive significantly influences your car insurance rates. State Farm considers factors like the vehicle’s make, model, year, and safety features when calculating premiums. Here’s a breakdown of how car insurance rates typically vary across different vehicle categories:

- Cars: Car insurance rates for passenger vehicles are generally lower than for trucks or SUVs, as they are statistically less likely to be involved in accidents. Factors like the car’s safety features, engine size, and fuel efficiency also impact premiums.

- Trucks: Pickup trucks, vans, and other commercial vehicles often carry higher insurance premiums due to their size, weight, and potential for carrying heavy loads. These vehicles are statistically more likely to be involved in serious accidents, contributing to higher insurance costs.

- SUVs: Sport utility vehicles (SUVs) typically fall somewhere between cars and trucks in terms of insurance rates. Their size and weight contribute to higher premiums, but they are generally considered safer than trucks due to their higher ground clearance and safety features.

- Motorcycles: Motorcycle insurance rates are significantly higher than those for cars, trucks, or SUVs. This is due to the inherent risks associated with riding a motorcycle, such as lack of protection in case of an accident and the increased likelihood of serious injuries.

Coverage Options for Different Vehicle Categories

State Farm provides a variety of coverage options for different vehicle categories, ensuring comprehensive protection tailored to your specific needs:

- Cars: State Farm offers a range of coverage options for cars, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection (PIP). You can customize your policy to include the specific coverages that best suit your individual needs and budget.

- Trucks: State Farm offers specialized coverage options for trucks, including commercial auto liability, cargo insurance, and physical damage coverage. These policies are designed to protect businesses and individuals who use trucks for commercial purposes.

- SUVs: State Farm provides comprehensive coverage options for SUVs, similar to those offered for cars. However, some policies may include additional coverage for features like towing and off-road driving.

- Motorcycles: State Farm offers a variety of coverage options for motorcycles, including liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments coverage. It is important to note that motorcycle insurance policies often have higher deductibles than car insurance policies, due to the higher risk associated with riding a motorcycle.

State Farm Car Insurance in Different States

State Farm, one of the largest insurance providers in the U.S., offers car insurance in all 50 states, the District of Columbia, and Puerto Rico. While its availability is widespread, the cost of coverage can vary significantly depending on the state. Factors such as traffic density, accident rates, and state regulations influence these rate differences.

Factors Influencing State Farm Car Insurance Rates by State

State Farm car insurance rates are influenced by several factors, some of which vary significantly from state to state.

- Traffic Density: States with high traffic density, such as California and New York, tend to have higher accident rates, which can lead to higher insurance premiums.

- Accident Rates: States with higher accident rates, such as Florida and Texas, generally have higher car insurance rates due to the increased risk of claims.

- State Regulations: State regulations, such as minimum coverage requirements and mandated benefits, can impact car insurance rates. For instance, states with higher minimum coverage requirements may have higher premiums.

- Cost of Living: States with a higher cost of living, including housing, medical care, and vehicle repair costs, may have higher car insurance rates.

- Demographics: Factors like age, driving history, and the number of drivers in a household can also influence rates.

State Farm Car Insurance Rates by State

State Farm’s average car insurance rates vary significantly across different states. For instance, in states like Florida, Texas, and California, the average premium can be considerably higher than in states like Maine, Vermont, and North Dakota.

“State Farm’s average car insurance rates in Florida are significantly higher than in Maine, largely due to Florida’s higher accident rates and cost of living.”

State Farm Car Insurance Rates Compared to Competitors

State Farm’s car insurance rates can be compared to those of other major insurers in each state. While State Farm may be competitive in some states, it may not be the most affordable option in others.

“For example, in Texas, State Farm may be more expensive than other insurers like Geico or Progressive, while in California, it may be more competitive.”

State Farm Car Insurance for Special Situations

State Farm offers a range of car insurance options tailored to meet the specific needs of drivers facing unique circumstances. Whether you have a high-risk driving profile, multiple vehicles, or specialized insurance requirements, State Farm has solutions designed to provide you with the appropriate coverage and financial protection.

High-Risk Drivers

State Farm recognizes that not all drivers fall into the “average” category. For drivers with a history of accidents, traffic violations, or other risk factors, State Farm offers specialized insurance programs. These programs may include higher premiums but provide essential coverage to ensure adequate protection.

Drivers with Multiple Vehicles

For individuals or families with multiple vehicles, State Farm offers multi-car discounts. These discounts can significantly reduce your overall insurance costs by bundling your vehicles under a single policy. State Farm also offers customized coverage options for each vehicle, allowing you to tailor your protection to the specific needs of each car.

Drivers with Specialized Insurance Needs

State Farm caters to drivers with unique insurance needs, such as those who drive high-value vehicles, classic cars, or vehicles used for business purposes. These drivers may require additional coverage options, such as collision coverage with a lower deductible, comprehensive coverage for damage caused by events other than accidents, and liability coverage exceeding the minimum state requirements.

Final Summary

Ultimately, finding the right car insurance policy comes down to individual needs, risk tolerance, and budget. State Farm offers a comprehensive suite of coverage options, discounts, and customer support, making it a strong contender for drivers seeking affordable and reliable insurance. By carefully considering the factors that influence rates and leveraging available discounts, you can find the best State Farm car insurance policy that aligns with your specific requirements and ensures you’re adequately protected on the road.